What’s the Federal Tax Credit for Electric Cars in 2021?

What's the federal tax credit for electric cars in 2021? Will the Biden administration give more incentives for buying EVs?

Feb. 18 2021, Updated 11:39 a.m. ET

Countries around the world are taking measures to increase the adoption of EVs (electric vehicles), by both prompting automakers to produce more electric cars by way of fuel economy standards and carbon credits, and providing incentives to EV buyers. Could the federal tax credit for buying electric cars change in 2021?

Joe Biden has shown his drive to promote clean energy by rejoinin the Paris Climate Deal and pledging to convert the massive U.S. government fleet to zero-emission vehicles. EV stocks have been rallying since Biden’s election last year.

What’s the federal tax credit for electric cars in 2021?

The federal tax credit for EVs and hybrid vehicles is capped at $7,500, but not all cars qualify for the credit. Under the current rules, the tax credit starts phasing out once an automaker sells 200,000 electric cars. Tesla and GM EVs don’t qualify for the federal tax credit, as they've already passed that threshold.

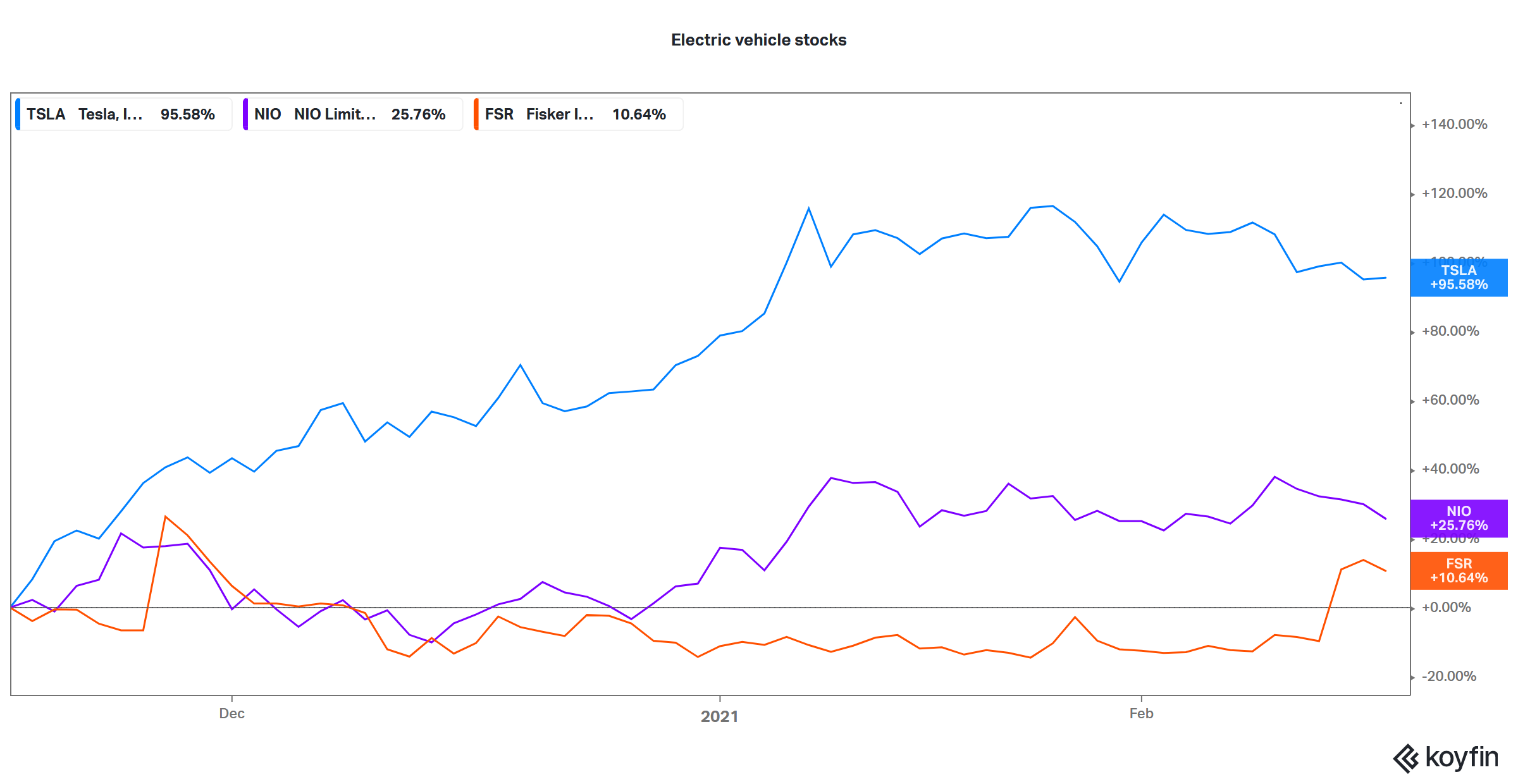

TSLA, NIO, and FSR stock performance

Also, the federal tax credit is upper bound by the total income tax you pay. For instance, if you pay income tax of $1,000 in 2021, you would receive a credit of only $1,000 and not $7,500.

Does the tax credit apply for leased vehicles?

You don’t get the federal tax credit if you lease an electric or plug-in hybrid car. The reasoning here is pretty straightforward—the credit is reserved for car owners. If you lease a car, you don’t own the title for the asset.

When you lease an EV, the leasing company gets the federal tax credit. But all isn't lost if you lease, as the leasing company adjusts your monthly lease payments to reflect the credit.

When does the federal tax credit for electric cars stop?

The federal tax credit for EVs tapers down once the automaker sells 200,000 eligible cars. For instance, Tesla’s EVs were eligible for the full $7,500 credit until the end of 2018, and then the credit was cut in half at $3,750 between Jan. 1, 2018, and June 30, 2018. For the next six months, Tesla cars were eligible for a $1,875 tax credit. Tesla cars then stopped qualifying at the beginning of 2019. In 2020, the company delivered almost half a million cars, and reached the milestone of 1 million cars sold.

GM's EVs and hybrids qualified for the full $7,500 federal tax credit until Mar. 31, 2019. For the next six months, the cars were eligible for a $3,750 credit, which was then tapered down to $1,875 between Oct. 1, 2019, and Mar. 31, 2020. Since Mar. 31, 2020, GM vehicles haven’t qualified for the credit.

Why the current tax credit system is flawed

There are some weak points in the current U.S. tax credit program for EVs. For instance, all electric cars qualify for the same credit, irrespective of their price. In contrast, China doesn't give incentives for buying higher-priced electric cars, but has made an exemption for NIO cars due to its battery swapping technology.

Also, the tax credit is limited to your income tax, so lower earners qualify for a lower credit. Another flaw is the gradual tapering down of the federal tax credit—the current system works because supply-side action encourages automakers to produce EVs.

Will Biden increase the federal tax credit for electric cars?

Things have changed over the last few years, and legacy automakers are committing themselves to EVs. One case in point is GM, which plans to sell only zero-emission cars by 2035. What we now need is an incentive structure to allow more people to buy EVs. Currently, their price is prohibitive for many Americans.

Many expect the Biden administration will announce a new federal tax credit program for EVs to increase their adoption. Given Biden’s views on climate change, that looks like a real possibility. Democrats have already introduced the GREEN (Growing Renewable Energy and Efficiency Now) Act, which seeks to increase the upper limit of 200,000 cars for the tax credit.