Does Plan B Owner Foundation Consumer Healthcare Have Stock?

Plan B is owned by Foundation Consumer Healthcare. Does the company have stock and is it publicly traded? Here are all the details for investors.

June 29 2022, Published 8:16 a.m. ET

Since the U.S. Supreme Court overturned the 50-year-old Roe v. Wade ruling, paving the way for states to ban abortions, the demand for Plan B contraceptives has shot through the roof. Plan B is owned by Foundation Consumer Healthcare. Does the company have stock and is it publicly traded?

Plan B is legal in some states, while others have put restrictions on its purchase. Also, amid the rush to buy Plan B, several pharmacies have put restrictions on the number of pills an individual can buy.

Kelso & Co. and Juggernaut Capital Partners own Plan B.

Plan B was previously owned by Israeli pharma company Teva Pharmaceuticals. Berkshire Hathaway also invested in the company but the Warren Buffett-led conglomerate has exited the position. The Oracle of Omaha has exited several pharma names including Pfizer and Merck. Instead, he poured billions into energy companies amid the rise in global crude oil prices.

Kelso & Co. and Juggernaut Capital Partners don’t have stock.

In 2017, Kelso & Co. and Juggernaut Capital Partners bought Plan B One-Step from Teva Pharmaceuticals for $675 million. Foundation Consumer Healthcare, which is operated by both these companies, manages Plan B now. Kelso & Co. and Juggernaut Capital Partners are private equity companies and don’t have stock.

Foundation Consumer Healthcare doesn't have stock either.

Foundation Consumer Healthcare doesn't have stock either and isn't publicly traded. It was formed in 2014 and Kelso & Co. and Juggernaut Capital Partners are its owners.

According to Foundation Consumer Healthcare, “It is dedicated to improving consumers’ lives by developing and growing a portfolio of differentiated over-the-counter (OTC) products.” The company has a fast-growing OTC portfolio.

Foundation Consumer Healthcare is based in Pittsburgh and has employees across the U.S. Apart from Plan B, its portfolio includes Bronkaid, St. Joseph, and Campho-Phenique.

In 2020, Foundation Consumer Healthcare bought seven brands from GlaxoSmithKline Consumer Healthcare — Breathe Right Nasal Strips, Children’s Dimetapp, Primatene Tablets, Anbesol, Alavert, Fiber Con, and Dristan. The acquisition enhanced Foundation Consumer Healthcare's reach to 32 markets.

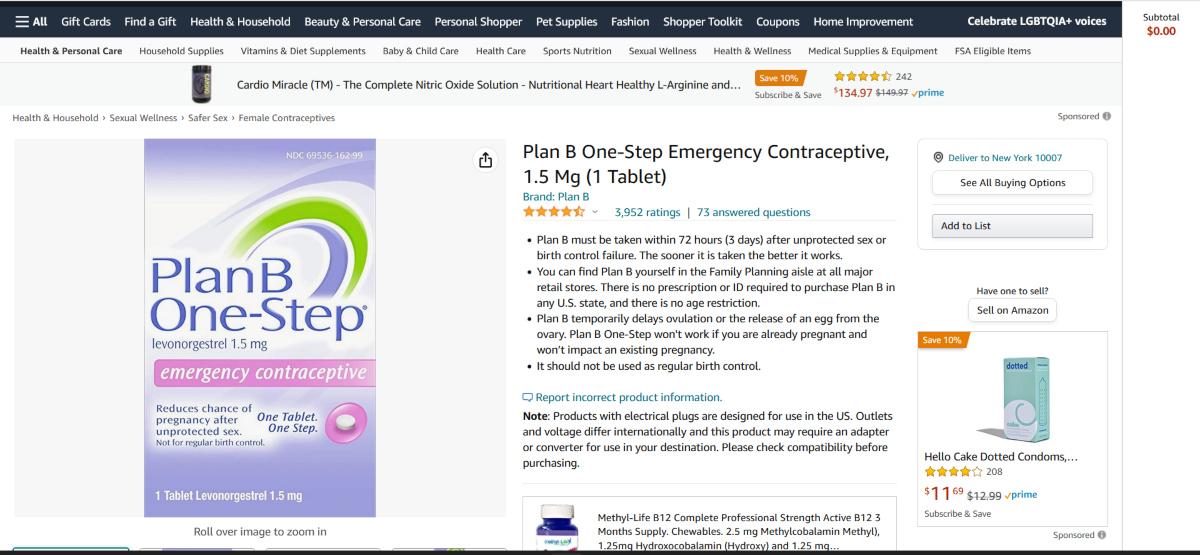

Plan B is in high demand now

Before the Supreme Court overturned Roe v. Wade, Plan B wasn't a very popular product on Amazon. However, the demand spiked after the Supreme Court's decision amid apparent hoarding.

Since Roe v. Wade has been overturned, nearly half of U.S. states are expected to ban abortion. Some of the tech companies have come forward and said that they would reimburse employees who need to travel for an abortion.

Also, there has been renewed interest in the abortion pill Mifeprex, which is manufactured by Danco Laboratories. The company has been quite secretive about its operations and even the FDA hasn't provided information. The FDA said that the company “may become the targets of threats of harm or violence.”

GenBioPro, which makes the generic version of Mifeprex, is also privately held. Like Danco Labs, little is known about GenBioPro.

How to invest in private equity funds

Juggernaut Capital Partners specializes in the consumer and healthcare industries. Currently, it has 24 active investments and has exited eight investments. Its funds have a total capital commitment of $1 billion and it's investing out of its $419 million JCP IV fund. In the U.S., only accredited investors can invest in private equity funds.