Avoid CTRM Stock Even Though Dry Bulk Sector Shines

CTRM stock has been dropping lately after witnessing a WSB-inspired pump. What is CTRM’s forecast for 2025 and is it a good dry bulk stock to buy?

April 20 2021, Published 1:04 p.m. ET

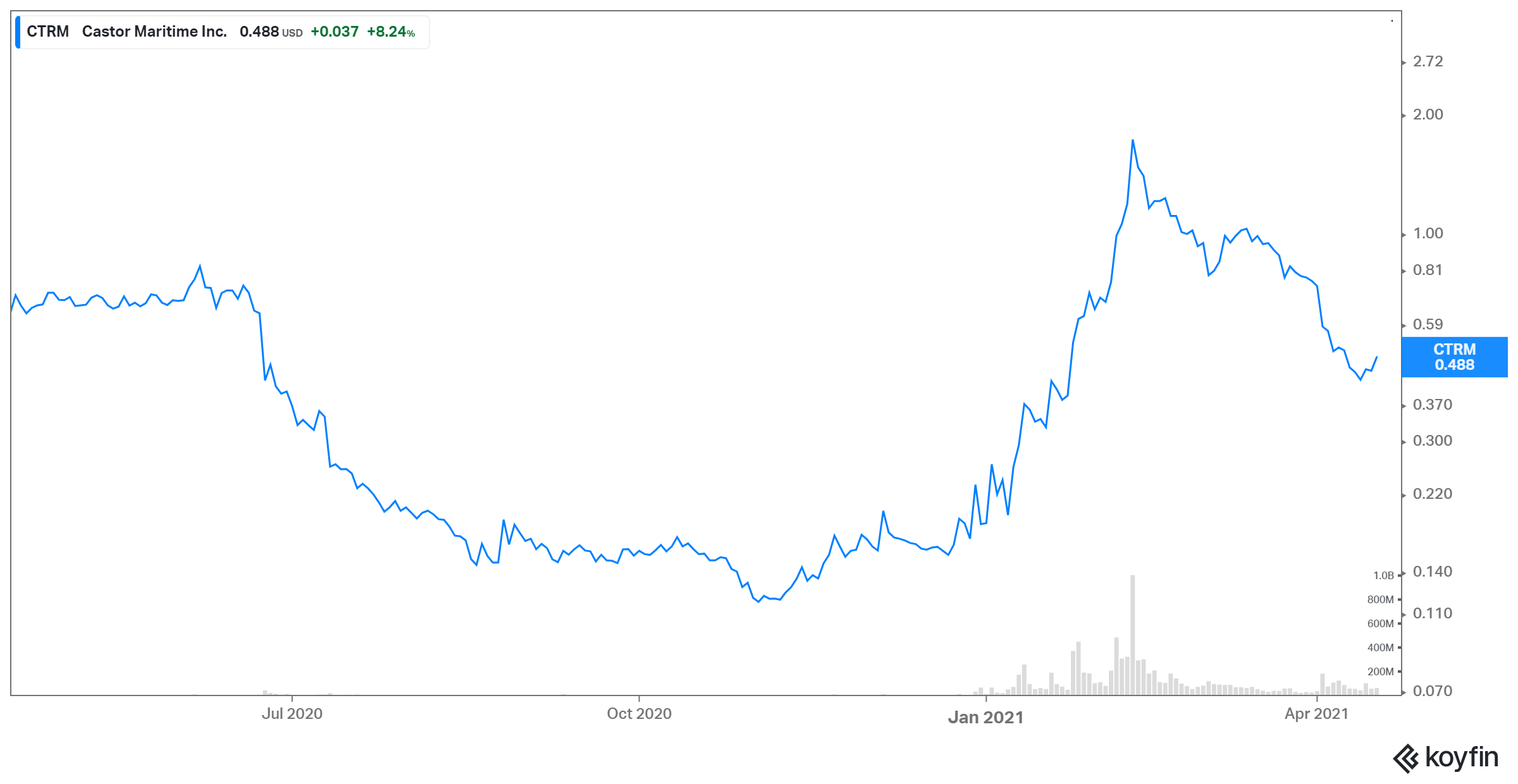

WSB (WallStreetBets) has pumped many stocks in 2021 and Castor Maritime (CTRM) was one of them. From trading at the low of $0.19 towards the end of 2020, it traded as high as $1.73 in February. Now, the stock is sharply down from its highs. What is CTRM's forecast for 2025 and is it a good dry bulk stock to buy?

Castor Maritime is a dry bulk shipping company that's aggressively targeting fleet growth, which is financed through share issues.

Why CTRM stock is falling

The WSB pump has left CTRM stock still 164 percent up YTD. This is despite a massive 72 percent drop from its 52-week high of $1.73 it reached in February. Like what has happened with most of the WBS pumped stocks, CTRM has lost a lot of the pump value lately. One of the reasons is the general risk-off sentiment in the market, which is leading investors away from growth and into value stocks. Also, the company has gone on a share issuance spree to finance its vessels, which is having a negative impact on investor sentiment.

CTRM stock forecast 2025

CTRM is a penny stock and it's difficult to say where the stock will be in five years. Given management’s stated strategy of fleet expansion, which has mainly been financed through debt and share issuance, its debt and equity are both expected to balloon going forward. They have already increased in the last few months.

Since interest rates are going up, the company might feel pressured to service its loans and the related finance costs. While an upcycle might lead the company to generate some revenues, an undisciplined strategy could mean that a downcycle might result in a very weak position for the company. As interest rates increased in 2009, the shipping industry saw many bankruptcies from companies that were excessively leveraged.

Will Castor Maritime stock recover?

Castor Maritime’s rally in 2021 had no legs and was mainly driven by the buzz around the WBS discussion. That momentum has mostly subsided, which means that it's hard to get any bounce from that front. One of the other factors driving the stock higher was potential short-squeeze activity in the stock. However, according to the most recent filing, CTRM stock’s short interest is only about 1.2 percent, which is low. A possibility of a short squeeze is highly unlikely now with such low short interest.

Another thing that could drive a recovery in the stock would be its fundamentals. Dry bulk shipping rates are surging higher due to COVID-19 vaccination drives globally and pent-up demand. Castor Maritime is on an aggressive fleet acquisition spree. With the announcement of a new vessel acquisition on April 19, the company now has 17 vessels. It has added 13 vessels this year alone.

Higher vessels amid strong freight rates sounds great for business. However, due to the WSB pump, the stock has already run up ahead of its fundamentals and most of the positives are already in the price. Therefore, any significant recovery from here for the stock isn't likely.

Long-term investors should avoid CTRM stock.

CTRM has been very active in the secondary share market since mid-2020 and has issued more than 450 million new shares and warrants since then. Its stock rally in 2021 led to the exercise of warrants, which further diluted the share count. Its common share capital has increased by a whopping 3,800 percent after 2020. Going forward, the company could keep on issuing more shares since its authorized capital stock is 1.95 billion shares. The company's stated goal is to increase the fleet, which would cause more stock dilution. While fleet growth is positive, a healthy company should finance its fleet expansion through its operating cash flows. However, it isn't generating much in the way of these cash flows.

As we discussed, most of the positives are already priced into the stock and it doesn’t offer much upside at this price. It's trading at EV-to-NTM sales multiple of 36x compared to a multiple of just 4.4x for Star Bulk Carriers, which is CTRM’s much bigger and stable peer. Eagle Bulk Carriers and Diana Sipping are trading at multiples of 3.5x and 3.9x, respectively. There aren’t many catalysts that can justify CTRM’s significantly higher valuation. Therefore, long-term investors should avoid the stock.