6 Crypto Exchanges That Let You Trade Without KYC Verification

For many crypto exchanges, you have to follow a KYC process. However, some crypto exchanges let you trade without KYC verification.

Jan. 12 2021, Published 8:18 a.m. ET

Cryptocurrencies have been gaining popularity among retail and institutional investors alike. However, cryptocurrency regulations are still evolving. Whereas many investors are interested in cryptocurrencies, they're not comfortable sharing their information. Which crypto exchanges let you trade without verification?

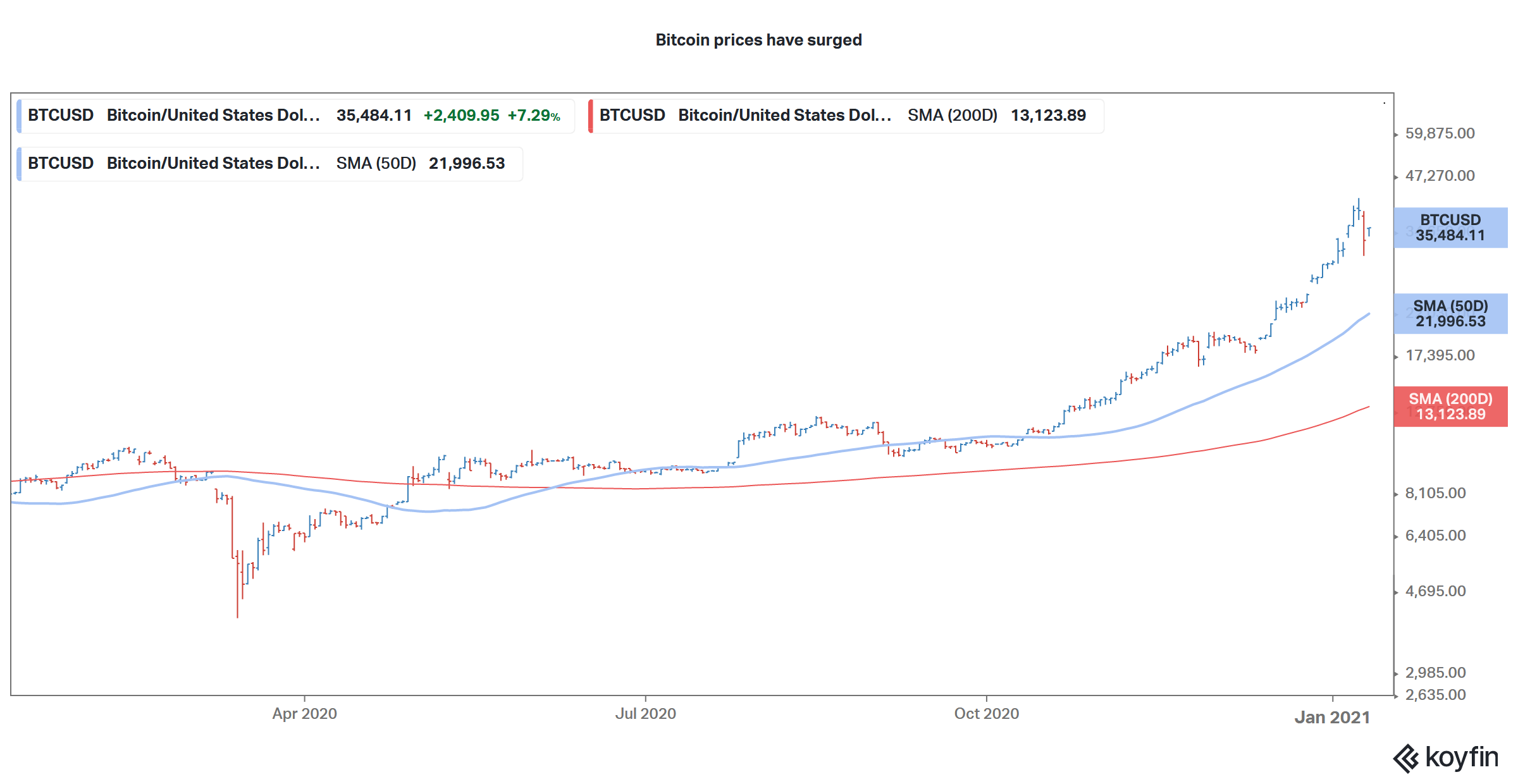

In 2020, bitcoin saw its price triple, and it was among the best asset classes. The bitcoin rally extended into 2021 before a fall in January. Opinions on cryptocurrencies vary. While Warren Buffett is very pessimistic about them, they're becoming more accepted as an alternative asset class. Many leading brokerages are positive on bitcoin. Last year, Citibank analyst Tom Fitzpatrick gave a bull case scenario where bitcoin could hit $318,000 by the end of 2021.

What's a crypto exchange?

Crypto exchanges help you buy, sell, store, or transfer digital currencies. Simply put, they're an intermediary between buyers and sellers of digital currencies, like stock exchanges are for those who trade in stocks.

For trading stocks, it's mandatory to complete KYC verification before you can open an account. Most brokers now let you complete this online. However, in contrast, some crypto exchanges will let you trade without giving identification.

No-KYC crypto exchanges

The following crypto exchanges don’t require KYC verification:

- Binance.

- Nominex.

- Bybit.

- Block DX.

- BitMax.

- Bitfinex.

While these exchanges let you trade without completing KYC verification, there are limits on trading and withdrawals. For instance, if you haven’t completed KYC, Nominex lets you withdraw up to 3 bitcoins in a day. Meanwhile, Bitfinex doesn't ask for verification if you want to trade, but it requires it if you want to deposit fiat currencies like the U.S. dollar or if you want to trade select stable coins. Without KYC verification, there's generally a restriction on withdrawal amounts.

Some exchanges have tightened their rules. IDEX used to be a no-KYC crypto exchange. However, it switched to mandatory KYC in 2019, and most users switched over to the new regime. KuCoin also implemented KYC requirements in 2018, and ShapeShift has started asking clients for their ID.

Exchanges that don’t insist on initial KYC verification allow higher trading limits and more account benefits if you show identification. Also, some crypto exchanges have a graded KYC structure. For instance, Kraken has starter, intermediate, and pro levels of verification.

Crypto exchanges that don’t require ID

Crypto exchanges that don't insist on the minimum KYC don’t require you to upload your id. Along with the abovementioned exchanges, Wall of Coins doesn't ask for ID. However, it asks for your phone number.

Over the years, many crypto exchanges have started asking for basic information from their customers. As regulations evolve, we might see more crypto exchanges practicing KYC verification. While this process will remove the anonymity that many cryptocurrency investors like, it will also offer more regulatory oversight and reduce the inflow of dirty money into the cryptocurrency market.