Buy These Stocks to Play the Global Chip Shortage Theme

There's a shortage of chips that are used in multiple industries. What stocks should investors buy to play the chip shortage?

April 2 2021, Published 11:57 a.m. ET

Globally, there's a shortage of chips that are used in industries ranging from automotive, appliances, and gadgets. There are a bunch of stocks that can benefit from the chip shortage, while many industries are impacted negatively. Which stocks should you buy to play the chip shortage?

The chip shortage can be attributed to the COVID-19 pandemic, which fueled the demand for gadgets like laptops, mobile phones, and gaming devices. Also, since an increasing number of smartphones are 5G enabled and use more chips, the demand for chips has been strong.

Global chip shortage and the COVID-19 pandemic

Automotive production has also bounced back and is amplifying the demand for chips. Several automakers including Ford had to curtail production amid the chip shortage. Chinese electric vehicle maker NIO also slashed its first-quarter delivery guidance citing the chip shortage. It had to curtail production for five days due to the shortage. Ford also highlighted the hip shortage as a risk to its 2021 earnings guidance.

How long the chip shortage could last

The global chip shortage will likely last for a few quarters if not a few years. There are two reasons why the chip shortage is here to stay. First, the demand continues to be strong across the spectrum. The global economy is rebounding and so is chip demand. Second, the chip supply can't be scaled up in a hurry. It can take almost two years for new factories to start rolling and commence production.

Chipmakers respond to the chip shortage.

Chipmakers are responding to the shortage with increased capital expenditure even though they aren't getting too exuberant with their spending amid concerns of an impending peak in the cyclical semiconductor industry. Micron is cautious with its capex outlay even though it has increased its capex budget for 2021.

Meanwhile, TSMC has increased its 2021 capex budget to between $25 billion and $28 billion in 2021, which is significantly higher than the $17.2 billion that it spent in 2020. Intel is also investing $20 billion in two new plants in the U.S. Semico expects the global semiconductor capital expenditure to rise 13 percent in 2021 to $127 billion. It forecasts that Samsung and TSMC will be the leading spenders in 2021.

Best stocks to buy and play the chip shortage

Companies like TSMC and Intel could be could ways to play the global chip shortage. Both of these companies are investing to ramp up their production and could benefit from higher chip demand in the future.

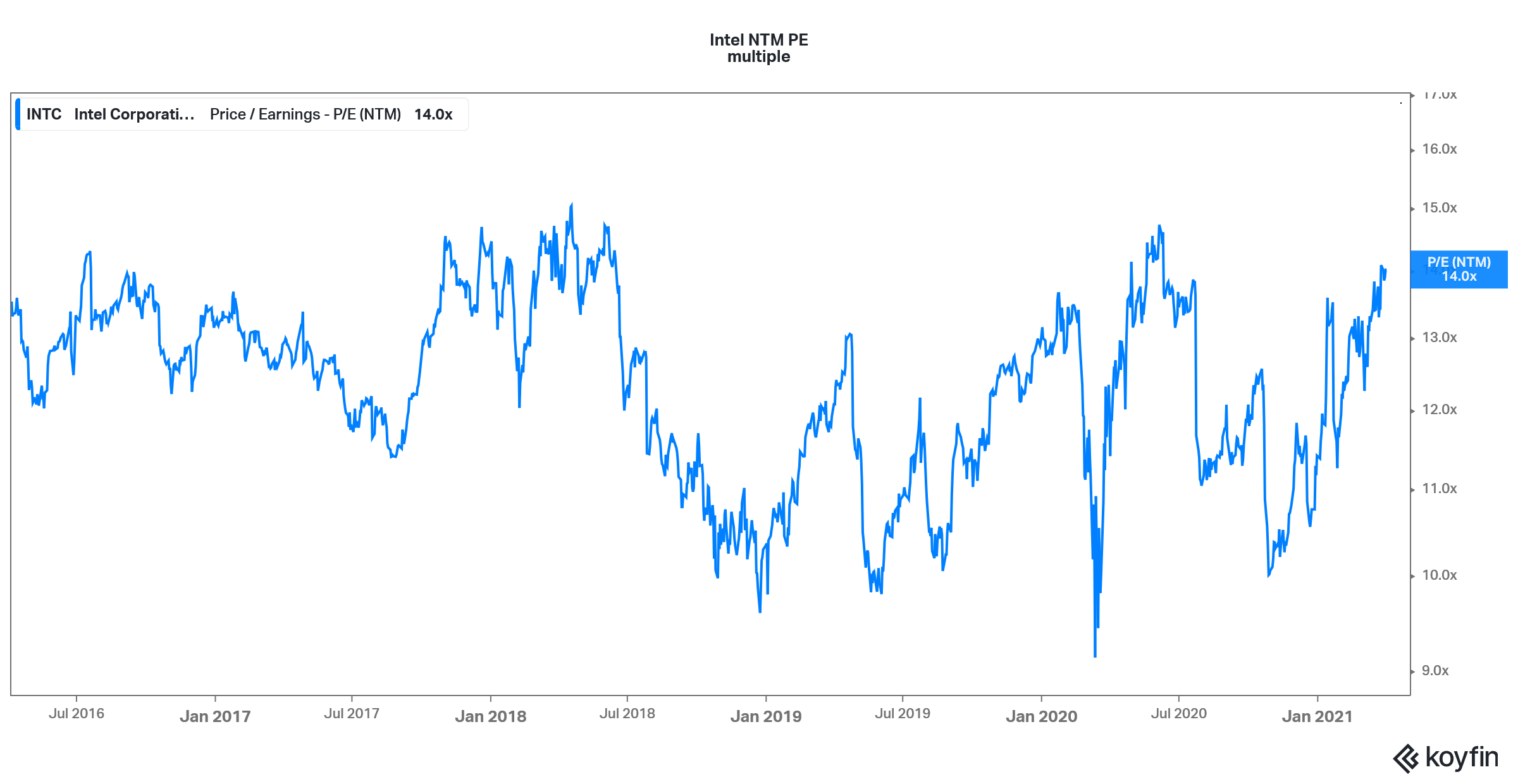

After seeing its market share being grabbed by rivals, Intel is working on an aggressive growth plan under CEO Pat Gelsinger. Intel stock trades at an NTM PE multiple of 14x, which looks reasonable.

Intel stock valuation

Another way to play the chip shortage would be to buy stocks of companies that produce equipment for chipmakers. Lam Research (LRCX) and Applied Materials (AMAT) are among the companies that would benefit as chipmakers pour billions into new plants. LRCX stock trades at an NTM PE multiple of 24.7x.

LRCX’s valuation multiples have expanded after the 166 percent spike in its stock over the last year. AMAT stock has also tripled over the last year and now trades at an NTM PE multiple of 23x.

Should you buy chip shortage stocks?

The global chip shortage is here to stay for some time. As sales of smart appliances grow, the demand for chips will also increase. We are also amid a smartphone supercycle led by rising sales of 5G phones. Soaring electric vehicle sales would also lead to higher chip demand.

The gaming console market is going through a cyclical uptrend, which will lead to higher chip demand. Overall, the outlook for all end chip users looks strong in the foreseeable future, which would mean good days for stocks that benefit from the global chip shortage.