How Chamath Palihapitiya Became the King of SPACs

Social Capital Hedosophia CEO Chamath Palihapitiya has mastered the art of SPACs. These are the SPACs he has launched.

Jan. 20 2021, Published 7:50 a.m. ET

SPACs (special purpose acquisition companies) were the preferred listing mode for companies in 2020. For the first time in history, the amount of money that SPACs raised rivaled the amount raised through the traditional IPO route. Chamath Palihapitiya, who some hail as the next Warren Buffett, has mastered the art of SPACs through his Social Capital Hedosophia Holdings. How many SPACs has Palihapitiya launched, and what companies did they merge with?

Some see the wave of SPACs as a bubble. However, they remain popular among companies going public. Even global private equity giant SoftBank launched a SPAC in 2020 to acquire a tech company.

A list of Chamath Palihapitiya's SPACs

The following are the SPACs launched by Palihapitiya:

- Social Capital Hedosophia Holdings I (IPOA).

- Social Capital Hedosophia Holdings II (IPOB).

- Social Capital Hedosophia Holdings III (IPOC).

- Social Capital Hedosophia Holdings IV (IPOD).

- Social Capital Hedosophia Holdings V (IPOE).

- Social Capital Hedosophia Holdings VI (IPOF).

While some of these have already merged with the intended companies, others still need to merge.

IPOA merged with Virgin Galactic

IPOA, Palihapitiya's first SPAC, took Virgin Galactic public and made it the first listed human spaceflight company. Elon Musk’s SpaceX, still a private company, is another company in the space travel industry. Virgin Galactic stock trades under the ticker symbol “SPCE” and has more than doubled over the last year.

IPOB merged with Opendoor

Palihapitiya’s second SPAC, IPOB, merged with Opendoor, an online real estate company. It listed in Dec. 2020 under the ticker symbol “DOOR” and has a market capitalization of over $15 billion. The stock is down almost 10 percent from the listing day but was up 24 percent in 2021 as of Jan. 19.

IPOC merged with Clover Health

IPOC merged with Clover Health on Jan. 8. As of Jan. 19, the stock had fallen 13.5 percent since the merger and had a market capitalization of a little under $2 billion. Clover, a health insurance company founded by Vivek Garipalli, is among the fastest-growing Medicare Advantage companies.

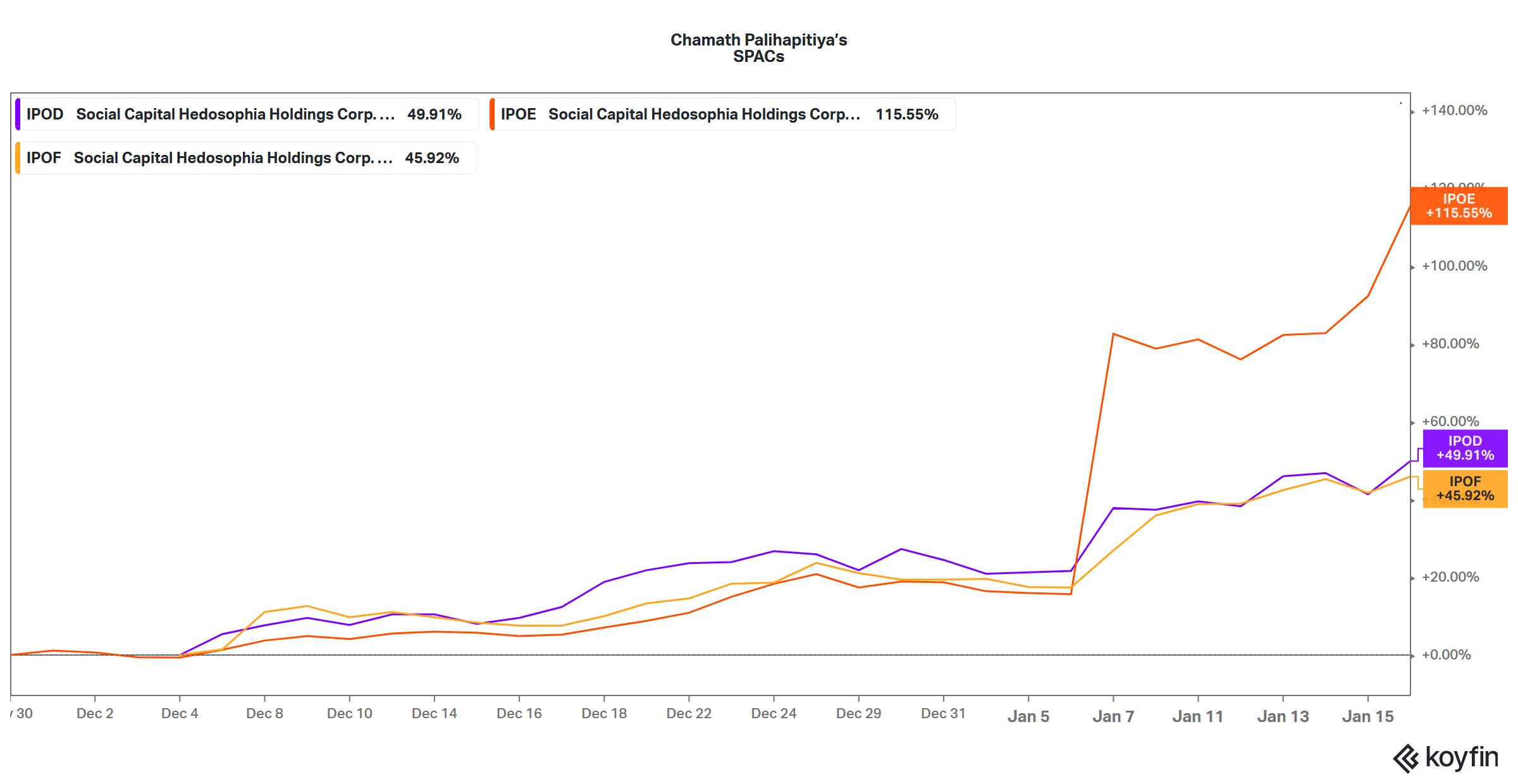

IPOD

IPOD was the fourth SPAC from Palihapitiya. It has raised $400 million from the listing and has a market capitalization of around $1 billion. IPOD had gained 50 percent since the listing as of Jan.19.

IPOE to merge with SoFi

In Oct. 2020, IPOE raised $700 million. It's set to merge with Social Finance of SoFi, a fintech company that aspires to get a banking license. The merger is expected to complete in the first quarter of 2021. In 2021, SoFi expects its revenue to rise 60 percent to $1 billion, and it sees itself turning EBITDA positive. IPOE stock has a market capitalization of $2.27 billion and had risen 115 percent since the listing as of Jan. 19.

IPOF is the biggest SPAC from Chamath Palihapitiya

IPOF, which raised $1 billion in 2020, is Palihapitiya's biggest SPAC. The SPAC also counts Twitter’s former CEO Richard Costolo as one of its members. The stock has a market capitalization of $2.2 billion, and as of Jan. 19, had gained 46 percent since the listing.

Chamath Palihapitiya’s next investment

Palihapitiya isn't done yet. On Jan. 19, he tweeted, “I’m working on a new climate investment. It will be a PIPE.” He has put his weight behind clean energy and predicts that the clean energy industry will make the first trillionaire. Could Tesla CEO Elon Musk, the world’s richest person, take up the honors? Let’s wait and see.