RPLA’s SPAC Merger Target Is Already Talking Dividends and Buybacks

Investors seeking bargain opportunities are looking at RPLA stock before its Finance of America merger. The stock is trading close to its IPO price.

March 18 2021, Published 7:26 a.m. ET

Fintech startup Finance of America is going public through blank-check company Replay Acquisition (RPLA). The deal is expected to close in a matter of weeks. Should you buy RPLA stock before the Finance of America merger?

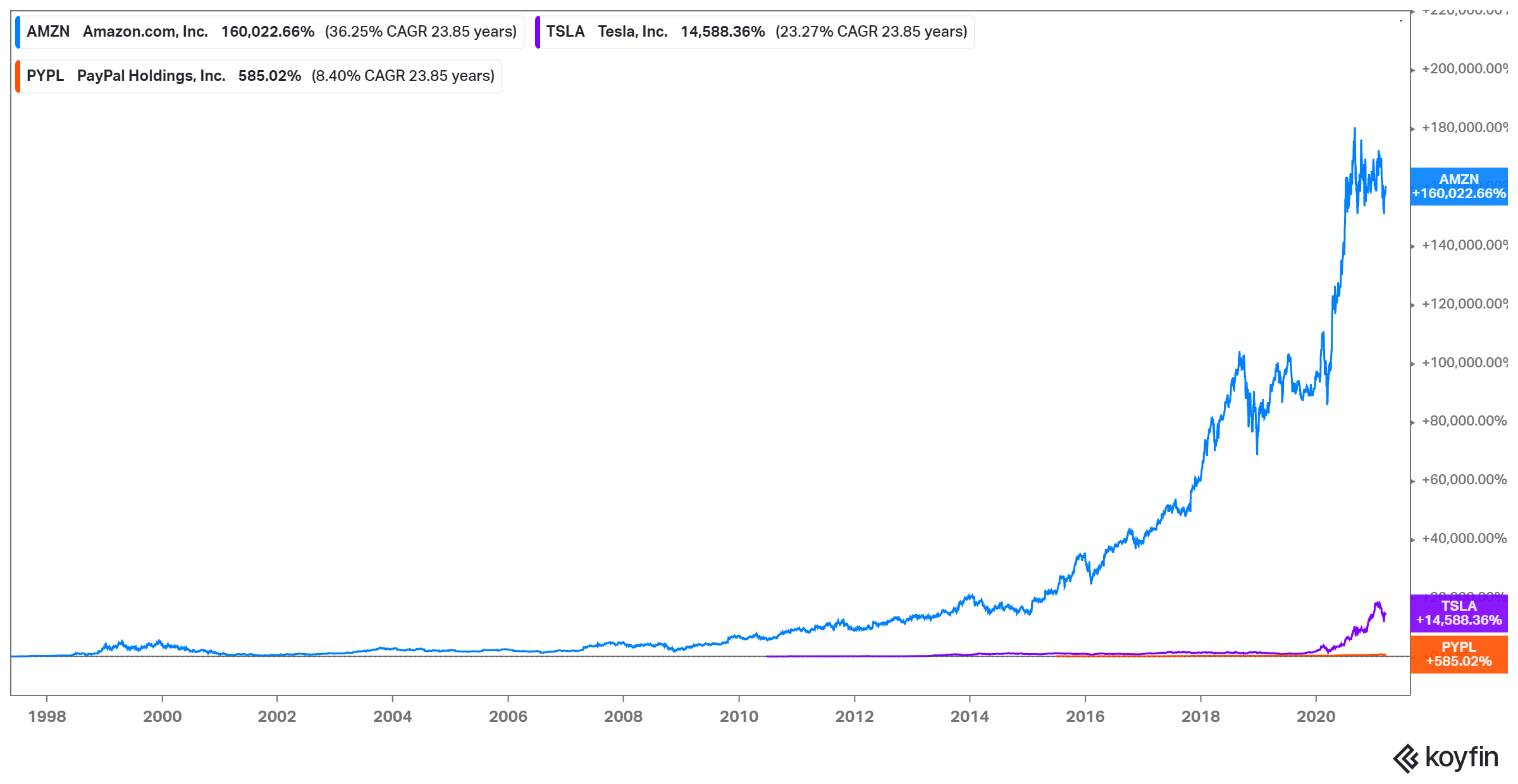

Finance of America stock is set to expand fintech stock options for investors. Other fintech startups going public through blank-check companies (or SPACs) include Payoneer (via FTOC), SoFi (via IPOE), eToro (via FTCV), and Paysafe (via BFT). UWM Holdings (UWMC) also took the SPAC route to the public market. SPAC stocks have offered retail investors exposure to businesses that could be the next Tesla (TSLA), PayPal (PYPL), or Amazon (AMZN).

When is the RPLA–Finance of America merger date?

A firm date for the RPLA–Finance of America merger hasn’t been set yet, but the parties have set their sights on completing the transaction in late March or early April. In such transactions, SPAC shareholders must vote to approve the deal before it can close.

Is Finance of America a good fintech merger target for RPLA?

Finance of America offers a broad range of financial services targeting consumers and businesses. Although smaller than competitors Rocket Companies (RKT) and UWM Holdings, Finance of America boasts a more diversified business. In addition to standard mortgages, it offers reverse mortgages, home improvement, and commercial lending, including loans for farmers. This diversification allows the company to keep growing regardless of the mortgage market. Its motto of “customer first, last, and always” has helped Finance of America build strong customer loyalty.

Lending to farmers is shaping up to be a lucrative business, generating $50 million in revenue for Finance of America in 2020. It expects that to grow to $500 million in 2021, and to as much as $1 billion in annual revenue later on.

Finance of America CEO Patti Cook told Benzinga in Feb. 2021 that the company generates a good amount of free cash flow, which it plans to invest in its future growth. Acquisitions will be part of that strategy. It recently bid on and won the assets of Renovate America, an acquisition set to expand Finance of America’s footprint in home improvement, where it sees a $400 billion addressable market.

Once Finance of America has set itself on a growth trajectory and built a strong balance sheet, Cook said the company may consider dividends or share repurchases to put money back into shareholders' pockets.

The RPLA–Finance of America merger: Everything you need to know

RPLA and Finance of America announced their merger agreement on Oct. 13, 2020. The deal values the combined company at $1.9 billion. To compare, Payoneer, SoFi, Paysafe, and eToro are going public in a deals valued at $3.3 billion, $8.7 billion, 9 billion, and $10.4 billion, respectively, and publicly traded competitors Rocket Companies (RKT) and UWM Holdings command valuations of $50 billion and $15 billion, respectively.

Finance of America is set to receive about $530 million in cash to invest in future growth. The amount consists of $250 million raised in RPLA's IPO and $288 million raised through PIPE transactions. The combined company will operate as Finance of America Companies and trade under the “FOA” symbol.

Should you buy RPLA stock before the Finance of America merger?

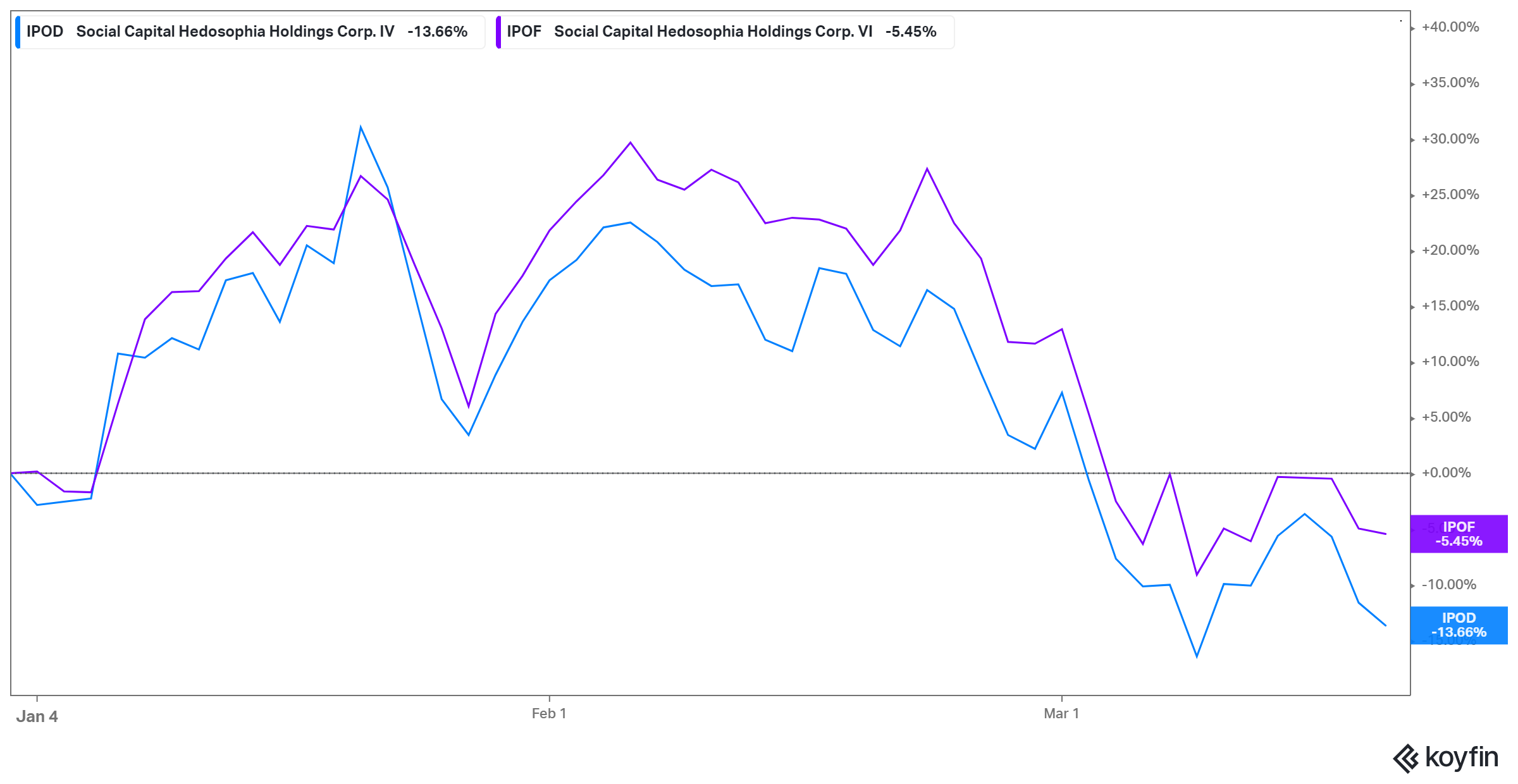

There are several reasons to buy RPLA stock. First, RPLA has passed a major hurdle for SPACs by finding a target business. With its Finance of America merger on track to close in a few weeks, the SPAC stock is a less speculative bet than pre-deal SPAC stocks like Chamath Palihapitiya’s IPOD and IPOF.

Second, Finance of America is a high-quality business with bright growth prospects. It’s rare to hear a startup going public through a SPAC talking about paying dividends this early.

And third, RPLA stock is still cheap at $10.14 per share, just 1.4 percent above its IPO price. The stock has been mostly stable since its debut, moving only 7 percent off its lows and highs. In contrast, IPOD and IPOF SPAC stocks are 35 percent off their peaks.