Investors Should Handle NBAC Stock Cautiously Before Nuvve Merger

NBAC stock will convert to NVVE stock after the merger with electric vehicle charging company Nuvve is complete. Should investors buy the stock before the merger?

Jan. 27 2021, Updated 8:30 a.m. ET

The Newborn Acquisition Corp. (NBAC) SPAC plans to merge with electric vehicle charging company Nuvve. The deal comes at a time when investors anticipate a boom for the electric vehicle industry with President Joe Biden in the White House. Is NBAC stock a buy ahead of the Nuvve merger date?

In what would be a major shot in the arm for EV charging companies like Newborn’s target Nuvve, the Biden administration has made the transition to clean energy in the transport sector a priority. The administration wants to lead by example and make the nearly 650,000 federal vehicles all-electric.

Before buying Newborn’s NBAC stock ahead of the Nuvve merger date, you should understand the company and its target. You need to know if the stock will be the right addition to your portfolio.

Chinese sponsors own Newborn SPAC

Chinese sponsors own the Newborn SPAC. It was formed in 2019 by Chinese fund managers, led by chairman and CEO Wenhui Xiong. Newborn conducted its SPAC IPO in February 2020. Initially, it sold 5 million shares at a price of $10 apiece and raised $50 million.

Due to the strong demand for NBAC stock, the sponsors grant underwriters more shares to cover overallotments. At the end of the day, the Newborn SPAC IPO raised $57.5 million, which the sponsors put in a trust account while they shopped for a private company to take public. They found Nuvve.

About Newborn NBAC target Nuvve

Nuvve is a California-based company that was started in 2010. It offers bidirectional charging solutions where it applies proprietary vehicle-to-grid (V2G) technology. Nuvve says that its technology helps lower the cost of electric vehicle ownership.

Although the company has done most of its business in Denmark, it has demonstrated its technology across five continents, including America. Nuvve has received funding from Toyota among other investors.

NBAC and Nuvve merger date

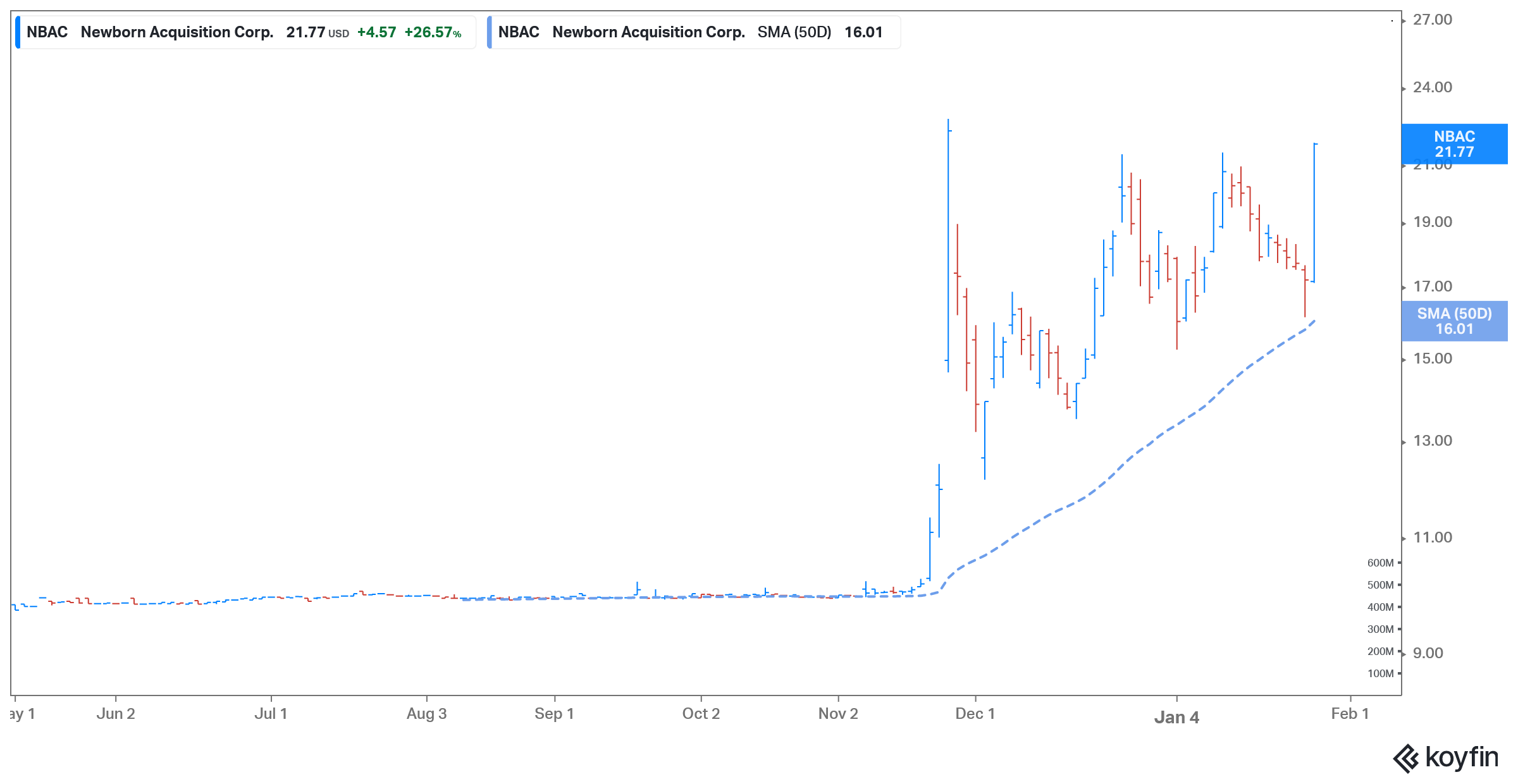

Newborn announced the agreement to take Nuvve public in November 2020. NBAC stock soared on the deal. The companies aim to complete the merger on Feb. 19, but that might not happen. Newborn shareholders will meet on Feb. 10 to vote on a proposal to extend the Nuvve merger date. It wants to extend the date by three months to May 19.

If shareholders approve the proposal and Newborn and Nuvve proceed to merge, the combined company would be called Nuvve Holding Corp. It would take the place of NBAC stock on Nasdaq and trade under the new ticker symbol “NVVE.”

The existing Nuvve management team would continue to lead the combined company.

SPAC sponsors usually retain a stake of at least 20 percent in the blank-check company after the IPO. Chinese investment veteran Xiong and the group behind Newborn would end up with a substantial stake in the combined company after NBAC stock converts to NVVE stock.

Nuvve’s valuation and cash injection

The Newborn deal valued Nuvve at $132 million. The deal will inject about $70 million into Nuvve. The amount includes the $57.5 million raised through the Newborn SPAC IPO and an additional $18 million raised through PIPE and bridge financing arrangements.

Is NBAC among the best EV charging stocks?

Combining with Nuvve will transform Newborn into an EV charging company alongside Tesla, Blink Charging, and ChargePoint, which is combining with SPAC Switchback Energy. The EV charging market is still underserved. As a result, the growth opportunities for EV charging companies like Nuvve is enormous.

Wait to buy NBAC stock until merger date is clear

Nuvve operates in an industry with bright prospects. President Biden’s plan to replace the government’s vehicle fleet with electric models should encourage broad adoption of electric vehicles, which should generate more business for Nuvve. The company’s target market is growing rapidly and is on track to exceed $17 billion in 2027.

While Nuvve looks like a good business to be part of, you may want to wait to buy NBAC stock until the merger date becomes clear. The fate of the deal lies with the crucial shareholder vote on Feb. 10. If Newborn SPAC shareholders reject management’s proposal to extend the deal’s deadline, then the merger with Nuvve might not happen, which would make NBAC stock look less attractive to investors seeking exposure to the lucrative EV industry.