Should You Buy IPOF Stock before Palihapitiya Finds a Merger Target?

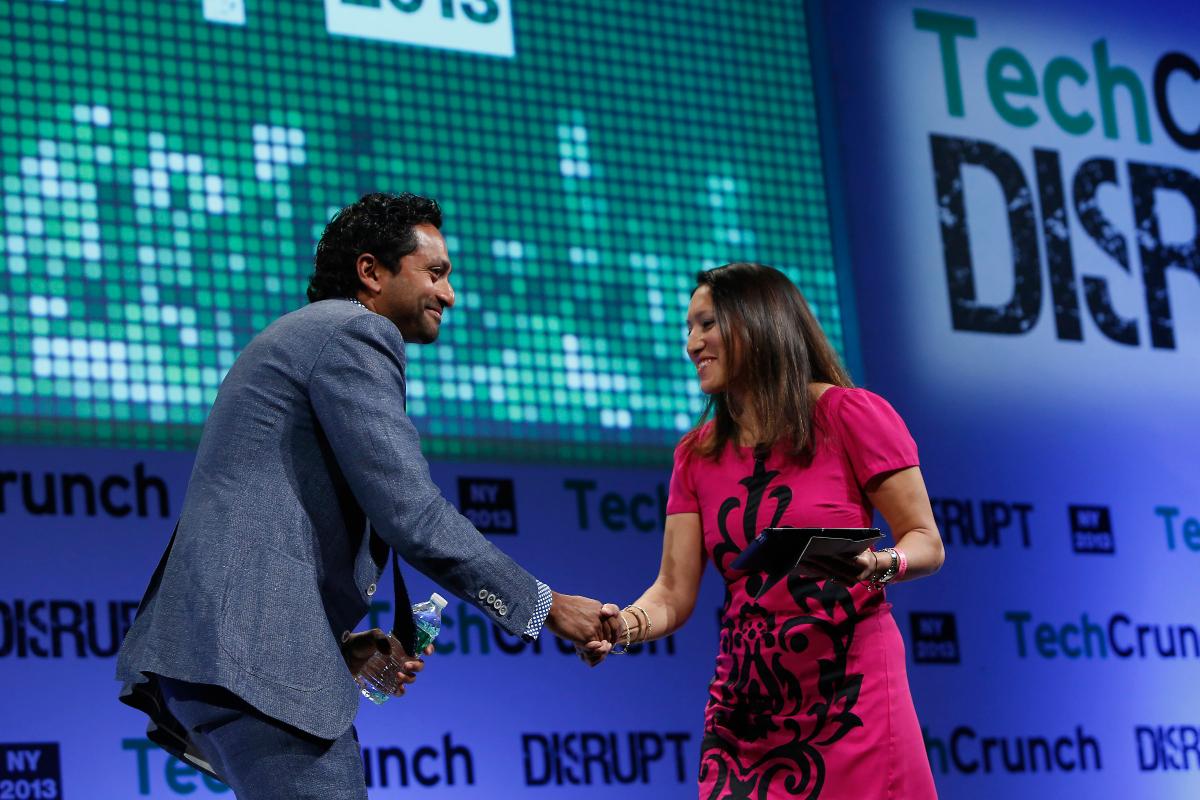

Chamath Palihapitiya has successfully merged three companies with his SPACs. Should you buy IPOF stock before it finds a merger target?

Jan. 25 2021, Published 7:43 a.m. ET

The craze for SPACs (special purpose acquisition company) has continued unabated in 2021. Chamath Palihapitiya, who many call the “King of SPAC,” has successfully merged three companies with his SPACs. Some of his SPACs have yet to find merger targets, including Social Capital Hedosophia Holdings VI Corporation (IPOF). Should you buy IPOF stock before Palihapitiya finds a merger target?

To be sure, investing in a SPAC before knowing what company it will eventually take public is like signing a blank check. They are known as blank check companies precisely for that reason. That said, the rewards are good if you can invest in a SPAC before the merger.

Last week, Climate Change Crisis Real Impact I Acquisition Corp (CLII) SPAC stock surged after it announced a merger with EVgo, an electric vehicle charging company. The same has been true about most other SPACs after they announced mergers.

Chamath Palihapitiya has launched 6 SPACs to date.

Chamath Palihapitiya's SPACs include:

- Social Capital Hedosophia Holdings I Corporation (IPOA)

- Social Capital Hedosophia Holdings II Corporation (IPOB)

- Social Capital Hedosophia Holdings III Corporation (IPOC)

- Social Capital Hedosophia Holdings IV Corporation (IPOD)

- Social Capital Hedosophia Holdings V Corporation (IPOE)

- Social Capital Hedosophia Holdings IV Corporation (IPOF)

Out of these, IPOA, IPOB, and IPOC have already merged with the target companies. IPOA in particular, which merged with Virgin Galactic, has been a success story for investors. IPOB and IPOC—which merged with Opendoor and Clover Health, respectively—have also done well. IPOE recently announced a merger with SoFi and has also surged. What’s the outlook for IPOF then?

Which company would IPOF merge with?

Like all other SPACs from Chamath Palihapitiya, IPOF intends to acquire a company in the technology industry. But then, the definition of technology as we have historically known it has broadened to include fintech companies, new-age insurance companies, as well as electric vehicle companies.

IPOF merger date

Last week, Palihapitiya tweeted that he would like to take Stripe public. However, the online payment processor is also said to be in talks to merge with Bill Ackman's SPAC, Pershing Square Tontine Holdings (PSTH). Incidentally, Ackman wanted to take Airbnb public through his SPAC, but the deal did not go through and Airbnb opted for a traditional IPO that received tremendous response from investors.

IPOD has also not found a merger target, but the stock is up over 70 percent from the IPO price. When he tweeted about Stripe, Palihapitiya did not specify whether he intends to merge the company with IPOD or IPOF.

Many have speculated that Palihapitiya might take Lucid Motors public next. The merger deal between Lucid Motors and Churchill Capital IV (CCIV) does not look as much like a done deal as it did a month ago. Palihapitiya might consider a green energy company as a target soon, considering his views on climate change. That said, since IPOF has not announced a merger date or a target, we can at best speculate on the possibilities.

Should you buy IPOF stock before the merger?

As previously stated, buying a SPAC before the merger is speculative. There is also the moral hazard of a PIPE (private investment in public equity) investor getting in at a cheaper valuation than what you would buy at. That said, looking at Palihapitiya’s track record in SPACs as well as PIPE, it would be worth betting on his expertise in finding a strong merger target and buy IPOF stock before the merger.