Investors Are Set To Pounce As Rumors Fly of a GSAH-BlockFi Merger

GS Acquisition Holdings Corp. II may have found a SPAC target in BlockFi. Investors are eagerly waiting for an update.

March 11 2021, Updated 10:03 a.m. ET

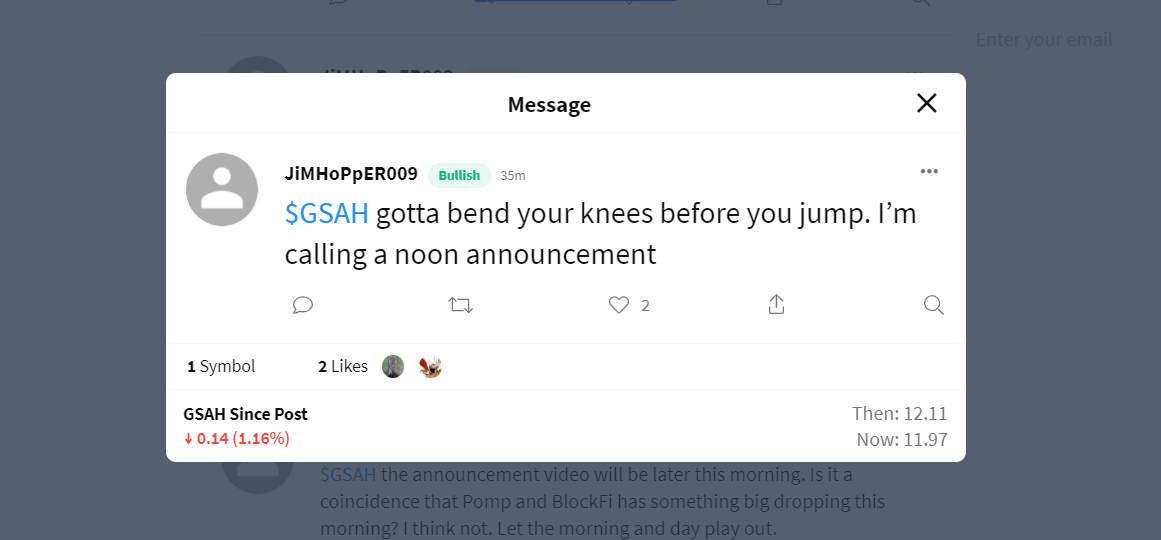

SPACs, or special purpose acquisition companies, have two years to merge with a target company from the day of their filing. GS Acquisition Holdings Corp. II (NYSE:GSAH) is rumored to have selected BlockFi as a target.

Right now, the news of a GSAH target is speculation, but there's excitement buzzing about that target being cryptocurrency trading platform BlockFi.

A rundown of the GSAH-BlockFi merger rumors

Staying true to its name, GSAH is being supported by Goldman Sachs (NYSE:GS) during its journey to secure a SPAC target. In response to the rumors that the SPAC is targeting BlockFi for a deal, GSAH shares have risen 10.65 percent from Tuesday's market close.

Initially, GSAH filed its registration statement with the SEC on June 24, 2020. That gives the company until June 24, 2022 to complete a merger, but it would be remiss not to get started raising capital much sooner. There are also some hints of a GSAH-BlockFi deal: Anthony Pompliano has joined BlockFi's board of directors and Goldman Sachs has stated that it's setting up its crypto trading desk once again.

What does BlockFi do?

BlockFi's offering is evident in its tagline: "Don't just buy crypto—start earning on it. Open an interest account with up to 8.6% APY, trade currencies, or borrow money without selling your assets."

Basically, BlockFi offers financial instruments tailored to investors interested in cryptocurrency, particularly bitcoin. Its products include cryptocurrency interest accounts, trading accounts, and crypto-backed loans. These products are unique because they go beyond trading and act like any other financial product on the modern market.

How does BlockFi make money?

BlockFi makes money by balancing its interest-yielding products with its interest-charging products (like interest accounts and loans, respectively). It borrows capital at the rate it pays users and then lends capital at a higher rate, which it offers for bitcoin, Ethereum, and Gemini dollar loans.

The BlockFi valuation is in the billions

On Feb. 12, 2021, BlockFi bagged a Series D funding round worth $2.85 billion. That was a big jump from its 2020 Series C round, which raised $50 million.

Will BlockFi definitely merge with GSAH, or will it go public via its own IPO?

Until an official announcement, there's always the chance that BlockFi could IPO on its own. It depends on how much GSAH values the company at. However, a SPAC is a more secure (and much quicker) route to the public domain. More companies are finding that benefit difficult to ignore.

In fact, Zac Prince (CEO of BlockFi) himself has touted the splendors of SPACs, stating, "The selling point of a SPAC is speed and there could be a scenario where based on what is going on in the crypto market this could be a very valuable way to go public."

Other potential GSAH SPAC merger targets

It's safe to say that GSAH will stay in the crypto domain, where there are several potential targets. Whatever the case, investors think an announcement could come any time now.