Best Natural Gas Stocks to Buy Now as Prices Rise in 2022

Energy prices have spiked since Russia invaded Ukraine. What are the best natural gas stocks to buy now in 2022 amid rising prices?

June 2 2022, Published 8:28 a.m. ET

There has been a lot of divergence among stocks this year. While tech and growth names have underperformed, the energy and materials sector has outperformed. Crude oil and natural gas companies are among the top gainers in the S&P 500 and even legendary investors like Warren Buffett have been attracted to energy stocks.

Global energy prices spiked after Russia invaded Ukraine. While rising crude oil and natural gas prices have pushed up inflation, and some of the emerging economies are facing a fiscal crisis amid soaring energy prices, it has also been an investment opportunity. What are the best natural gas stocks to buy in 2022 amid rising prices?

Should you buy natural gas stocks?

The global energy markets are in for a structural change. Russia has weaponized its natural gas exports by stopping exports to several European countries which it finds “unfriendly.” As Europe works towards shunning Russian natural gas, the market might remain tight longer. Higher natural gas prices would mean more revenues and profits for natural gas companies.

How to invest in natural gas

There are several ways that you can invest in natural gas, including:

- Trading in natural gas futures

- Natural gas ETFs

- Investing in companies that produce natural gas

- ETFs of natural gas producers

All of these avenues have different risk-return payoffs and you have to weigh the investment option against the individual risk appetite.

Best natural gas stocks to buy now

Thanks to the rise in natural gas prices, stocks of companies that produce natural gas have also spiked. Stocks of natural gas companies are a good way to gain exposure to the sector. The following companies are among the best natural gas stocks to buy now.

- Cheniere Energy

- Chesapeake Energy

- Southwestern Energy

Cheniere Energy is the largest LNG company in the U.S.

Cheniere Energy (LNG) is the largest LNG company in the U.S. and the second-largest globally. As the U.S. scales up its LNG exports, companies like Cheniere Energy should see higher revenues in the coming years.

Cheniere is a full-service LNG company. It buys natural gas from North America and converts it into LNG, which it either loads into customer containers or gives an option to deliver LNG to its customers' regasification facilities.

The company has contracted 85 percent of its production capacity, which means that it doesn't benefit as much from the rise in spot natural gas prices. The higher percentage of contracted sales also gives Cheniere Energy stable and predictable cash flows. LNG stock trades at an NTM EV-to-EBITDA multiple of 8.6x, while its dividend yield is just below 1 percent.

Chesapeake Energy has a high mix of natural gas in its production mix.

Chesapeake Energy (NYSE: CHK) has a high share of natural gas in its production mix. In the first quarter of 2022, 87 percent of its production was natural gas, while the remaining 13 percent was liquids. Chesapeake Energy’s cash flows have spiked and it generated adjusted free cash flows of $532 million in the first quarter of 2022, which was the highest in its history.

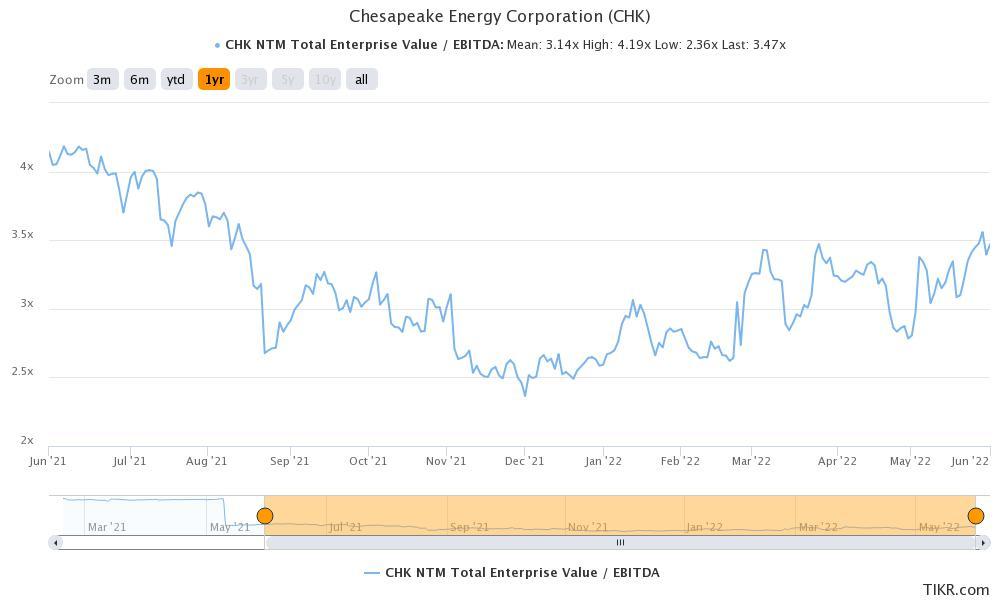

CHK is among the best ways to play natural gas. The company also pays a good dividend. For the first quarter of 2022, it announced a dividend of $2.32 per share, which includes a base dividend of $0.50 and a variable dividend of $1.84. The dividend yield turns out to be 2 percent at the base dividend, which looks healthy. With an NTM EV-to-EBITDA multiple of just under 3.5x, Chesapeake Energy looks like a natural gas stock worth considering.

Southwestern Energy is among the largest natural gas producers in the U.S.

Southwestern Energy (NYSE: SWN) is the second-largest natural gas producer in the U.S. In the first quarter of 2022, almost 90 percent of its production was gas while the remaining was liquids. Southwest Energy can deliver around two-thirds of its natural gas production to the LNG corridor and Gulf Coast, which is an added advantage.

While SWN doesn't pay a dividend, the company has been using cash to lower its debt. It had a total debt of $4.9 billion at the end of March 2022, while the net debt-to-adjusted EBITDA multiple was 1.7x. SWN stock has an NTM EV-to-EBITDA multiple of 4.5x. As the company further lowers its leverage, it could also see a rerating of its valuation multiples.