How Investors Can Get Ready for the SPAC Bubble Bursting

The market is getting worried about the SPAC bubble bursting. This seems inevitable as optimistic valuations are luring investors to unproven businesses.

Jan. 29 2021, Published 9:54 a.m. ET

The SPAC market really took off in 2020. More than 230 SPAC IPOs were completed that year for $80 billion, outnumbering the total for the past decade. Whereas the SPAC boom has continued in 2021, some cautious investors are asking if SPACs are in a bubble. They're also wondering what will happen when that bubble bursts.

Meanwhile, SPAC deals continue to attract billionaire Wall Street veterans, politicians, and celebrities. What's encouraging these SPAC listings, and how do they compare with traditional IPOs?

What you should know about SPACs

If you’ve invested in a SPAC or considering investing in one, you should know what you’re getting into. First and foremost, "SPAC" is short for "special-purpose acquisition company." A SPAC is a shell company in the sense that it lacks commercial operations.

Behind every SPAC, there's are sponsors that formed the shell company. They're typically investment veterans. The sponsors offer the initial funds to set up the shell company, and then go out to market it to prospective investors.

SPAC sponsors typically retain a stake of at least 20 percent in the company. In addition to bringing on board more investors to put money into the project, the sponsors are responsible for hunting for the private company the SPAC will acquire and combine with. SPAC IPO investors have no prior knowledge of the type of business the SPAC will end up merging with, which is why SPACs are also called "blank-check companies. But they hope the sponsors will find a good deal.

A SPAC typically has two years to complete a merger. If that fails, it may be forced to dissolve and refund its IPO investors, and the sponsors would lose their initial investment in the company. A SPAC IPO is typically priced at $10 per share.

Chamath Palihapitiya: The SPAC king

Billionaire venture capitalist and former Facebook executive Chamath Palihapitiya is among the most active figures in SPACs. He's launched several blank-check companies. It was Palihapitiya's Social Capital Hedosophia SPAC that took Richard Branson’s Virgin Galactic public in 2019. And in what Palihapitiya described as his biggest climate change investment, he led a PIPE (private investment in public equity) that raised an additional $415 million to take electric bus maker Proterra public. Besides Palihapitiya, other prominent SPAC names are Bill Ackman, Michael Klein, and Bill Foley.

A SPAC versus a traditional IPO

Whereas SPACs and traditional IPOs both bring private business to the public market, they contrast in many ways. The traditional IPO process is typically long and expensive. It starts with the company launching a campaign to persuade large investors to purchase its shares. The company may also need to pay an investment bank to help it hawk its shares to deep-pocketed investors.

Additionally, a company going public through a traditional IPO will need to satisfy stringent regulatory and exchange requirements. For example, SEC rules require that a company should have at least $100 million in revenue when going public. This bar can be too high for some companies, thereby blocking them from going public through a traditional IPO.

SPACs have solved the IPO headache for small companies by following the IPO process on behalf of the businesses it acquires. Since a SPAC has no commercial operations, it can go through the process quickly. The other advantage SPACs enjoy is that they can talk about their rosy financial projections to woo investors. Companies opting for a traditional IPO can't do this—they're required to show investors how they performed in the past year, not what they hope to generate in the future like a SPAC.

Bilionaire venture capitalist Chamath Palihapitiya at TechCrunch Disrupt NY 2013.

Are SPACs in a bubble?

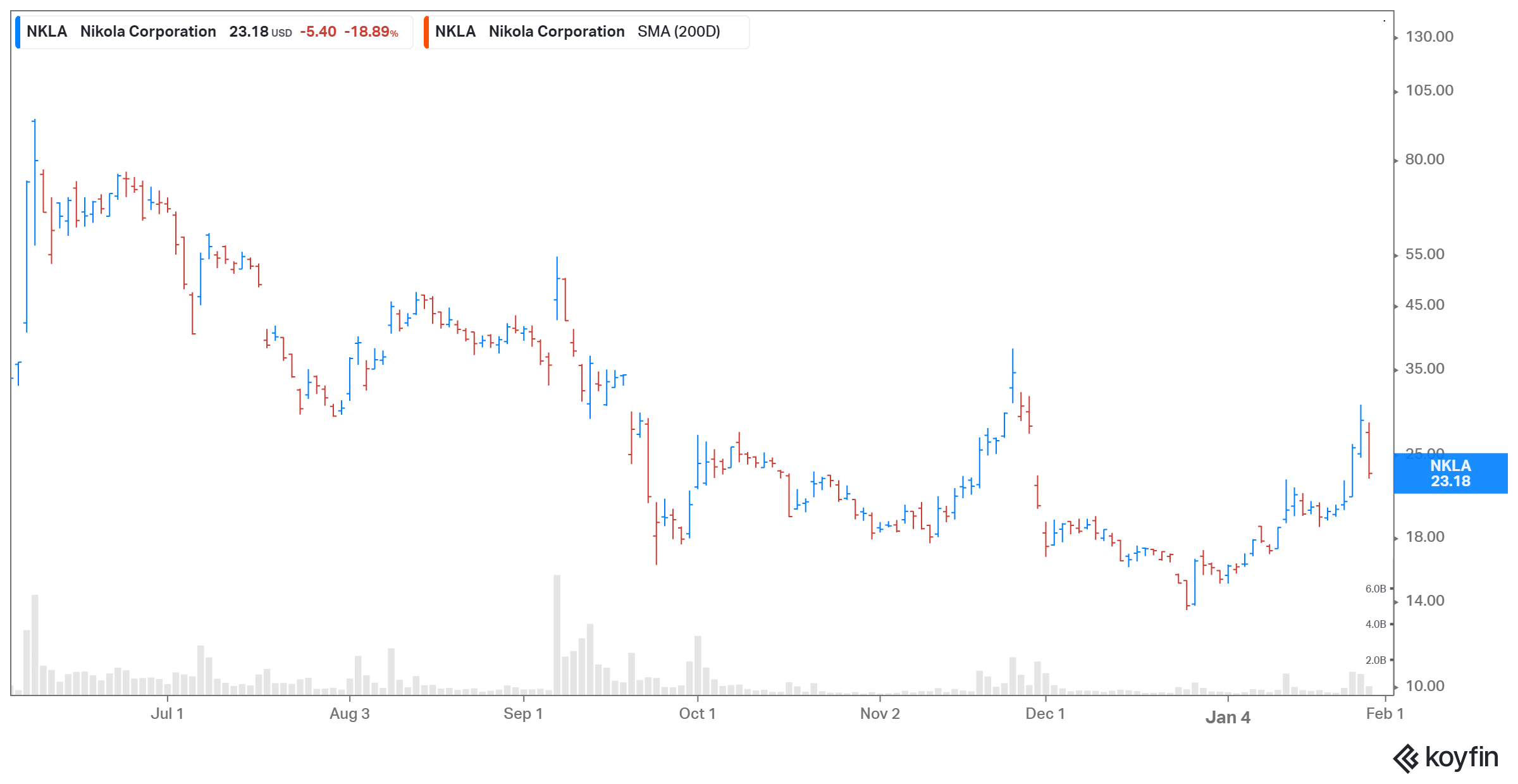

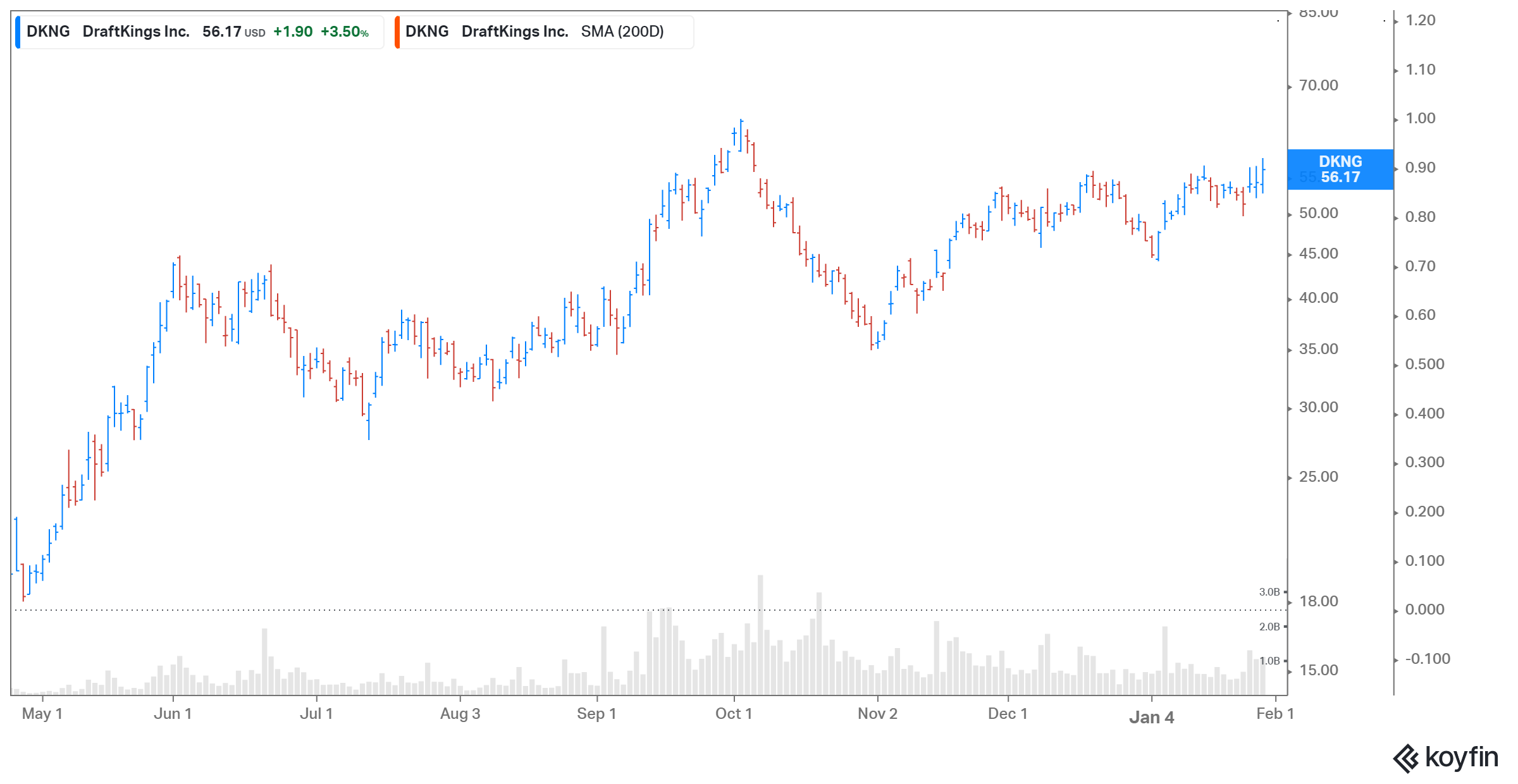

Many fans of traditional IPOs see the SPAC boom as a bubble that will burst sooner or later. As they can draw in more investors with optimistic forecasts, SPAC stocks typically soar after the company announces a deal. Companies in the electric vehicle industry have been a favorite among SPACs. Many go on to debut at lofty valuations despite generating little or no revenue and zero profit.

Because SPACs must close a merger in two to three years, sponsors may rush to a bad deal. And because retail investors using apps typically do little due diligence on a stock, SPAC shares may soar regardless of the quality of the company.

Will the SPAC bubble burst?

The low-interest environment means that bonds aren’t as attractive to investors. As a result, investors are rushing to the stock market for opportunities to invest their idle cash, and SPACs are welcoming them with open arms. So it may not necessarily be a bubble. But when investing in SPACs, you should pay attention to the warnings they put out about their financial projections—it may save you from burning your fingers when the SPAC bubble bursts.