Alight Solutions Looks Like a Buy Ahead of Its WPF Merger

Alight Solutions is set to go public through a reverse merger with WPF. What's Alight (ALIT) stock's forecast after the merger?

June 30 2021, Published 9:54 a.m. ET

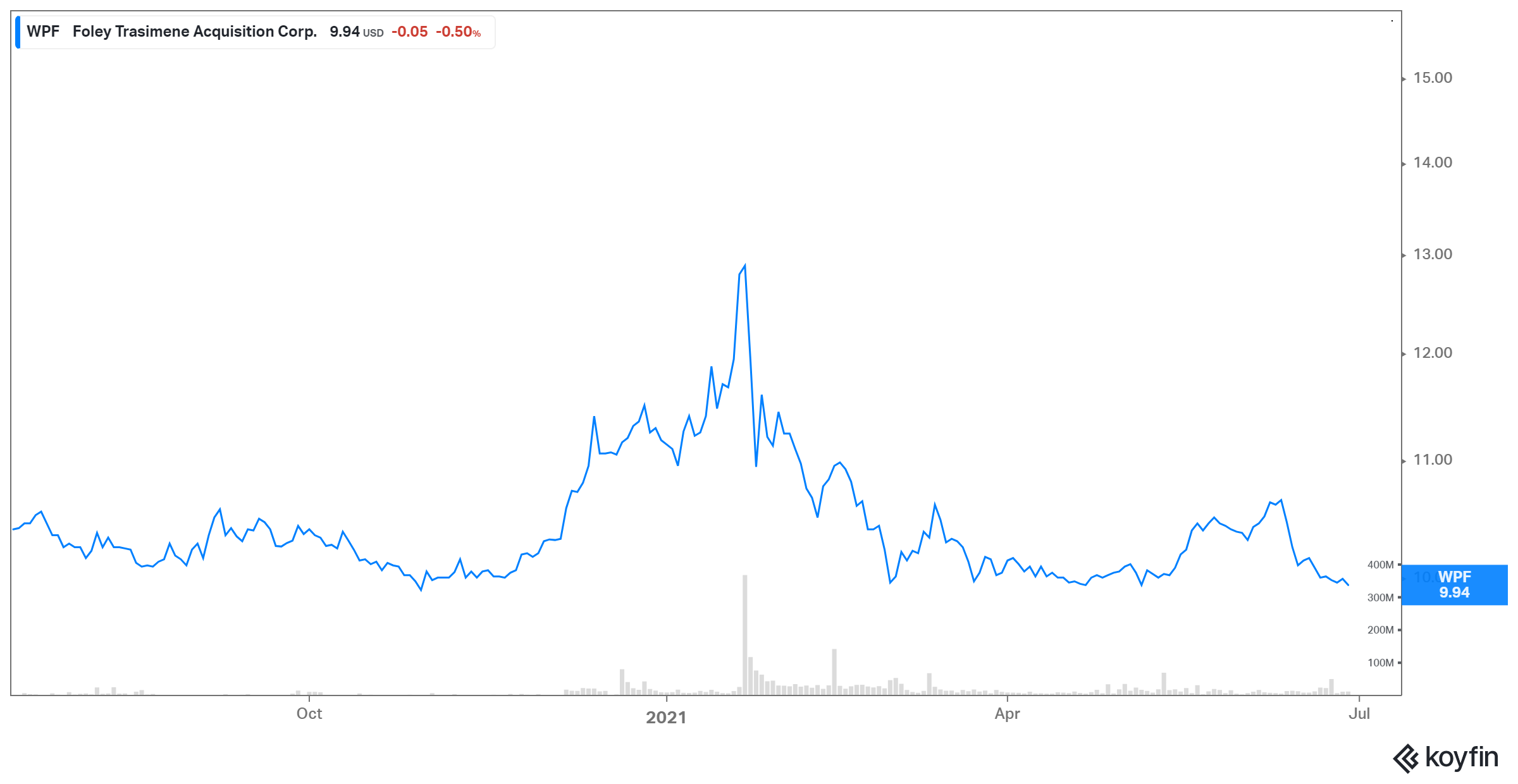

In Jan. 2021, Foley Trasimene Acquisition announced it would be taking Alight Solutions public. Alight was initially planning to go public through a traditional IPO at a valuation of $800 million in 2019, but scrapped the plan due to unfavorable market conditions. As the merger vote nears, what's Alight (ALIT) stock's forecast after the WPF merger date?

Alight Solutions is a cloud-based provider of integrated digital human capital and business solutions. It provides benefits administration and HR services to large companies, operates in around 200 countries, and serves more than 30 million people. Until 2017, it was part of insurance broker Aon.

When is the WPF vote on the Alight merger?

WPF shareholders' merger vote meeting is scheduled for Jun. 30, 2021. After the merger's closure, Alight stocks and warrants will start trading on the NYSE under the ticker symbols "ALIT" and "ALIT.WS", respectively, on Jul. 1.

Alight's valuation

The deal gives Alight an enterprise value of $7.3 billion and will provide Alight with around $2.9 million in cash proceeds to fund growth initiatives. The amount includes about $1 billion in cash held by WPF in trust and $1.6 billion in PIPE. After the transaction closes, WPF investors will own 19.2 percent of Alight.

Since WPF’s current stock price is close to its listing price of $10, its pro forma EV is $7.3 billion. Based on this EV and Alight’s projected sales, its valuation multiples come in at 2.7x (2021 sales), 2.5x (2022 sales), and 2.3x (2023 sales), respectively. Its multiples are lower than those of competitors Automatic Data Processing (ADP) and Paychex (PAYX), which have next-12-month EV-to-sales multiples of 5.4x and 8.9x, respectively.

Alight’s new board

On Jun. 29, Alight announced changes to its board of directors, which will be effective upon the WPF-Alight merger's closure. The board will comprise eight directors led by chairman William P. Foley II. The new board will bring deep industry experience across cloud, payment, and financial technology, enterprise services, legal and regulatory affairs, capital markets, and M&A.

Is Alight Solutions a buy after the WPF merger?

Alight’s cloud solutions help businesses scale up. Currently, 70 percent of Fortune 100 companies and 14 percent of the U.S. working population are Alight clients. The company is building its business-process-as-a-service (BPaaS) platform, which will include the Wealth Cloud, Health Cloud, and Payroll Cloud. It expects a significant portion of its revenue to come from this, with that share rising to 50 percent in 2023 from 13 percent currently.

Investors should also note that the global business process outsourcing market is on track to grow to $405.6 billion in 2027 from $221 billion in 2019, and Alight seems well positioned to take advantage of this opportunity.

Another factor favoring Alight is its high percentage of recurring revenue, which currently stands at close to 82 percent. This type of revenue stream provides certainty to a business. The company also expects to report adjusted EBITDA and free cash flow of $600 million and $465 million in 2021, respectively, and $768 million and $607 million in 2023. A company focused on profitability as much as growth is a rare find these days.