How’s the U.S. Economy Doing? Depends on Who You Ask

The U.S. economic indicators have been mixed over the last few months. How’s the U.S. economy doing in 2022? The answer depends on who you ask.

Aug. 12 2022, Published 10:37 a.m. ET

Many investors have been concerned about the health of the U.S. economy. The economic indicators have been mixed over the last few months. How’s the U.S. economy doing in 2022?

First, the U.S. economy contracted in both the first and second quarters of 2022. To make things worse, the inflation rate is above 8 percent, a pace of price rise that the country hasn't seen in decades. So, it goes without saying that all isn't well with the world’s largest economy.

How’s the U.S. economy doing?

To gauge how the U.S. economy is doing, we’ll need to look at several economic indicators. So, the country’s GDP contracted by 1.6 percent in the first quarter of 2022 and another 0.9 percent in the next. It's the first time since 2020 and the second time since the 2008–2009 financial crisis that the country’s GDP has contracted for two consecutive quarters.

U.S. inflation rose at an annualized rate of 8.5 percent in July. The reading was below the 9.1 percent that we had in the previous month and was also below the 8.7 percent that economists were expecting. The producer price index contracted 0.5 percent in July while economists were expecting it to rise 0.2 percent.

Meanwhile, U.S. durable goods orders increased in both May and June, after having contracted in the previous two months. It's a key metric and shows the capex investments by companies. The June core goods order, which among others removes government spending, also increased YoY.

The U.S. job market has been strong.

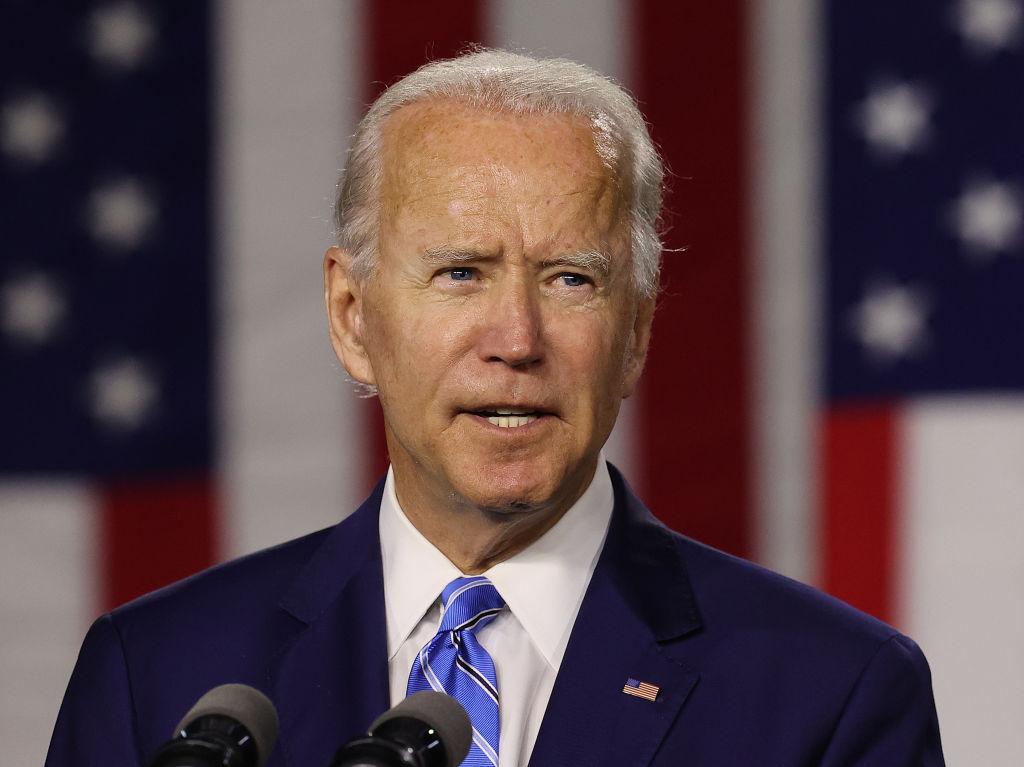

President Biden’s tweet on the U.S. economy created a controversy as he said that inflation has fallen to zero. He was correct in a sense as the July inflation was flat compared to June. Where Biden wasn't playing with the data is on the job market though. The U.S. economy added 528,000 jobs in July, which was twice what analysts expected.

Although the weekly jobless claims are up from their lows, the country’s unemployment rate of 3.5 percent is the lowest in over 50 years. While there have been reports of layoffs from leading tech companies, and most Big Tech companies have gone slow on hiring, the overall job market has been strong.

Democrats and Conservatives spar over the health of the economy.

With the economic indicators being mixed at best, Democrats and Conservatives have been sparing over the health of the economy. Conservatives blame Biden for pushing the U.S. economy into a recession, as globally two consecutive quarters of GDP decline is seen as a recession. However, the NBER (National Bureau of Economic Research) doesn't go by this definition.

Even on inflation, Biden has faced “Bidenflation” barbs while the price rise has been largely a global affair. This isn't to say that the administration’s policies haven't added fuel to the fire as the massive stimulus has been inflationary.

U.S. debt is soaring.

One metric that hasn’t got as much attention as it should is the impending debt crisis. The total U.S. national debt is now approaching $31 trillion and the debt-to-GDP ratio is around 123 percent.

Another related urgency is the student loan crisis. After President Donald Trump, Biden has also extended the moratorium on student loans multiple times. Biden is now facing calls to cancel student loans but it would have repercussions on the national debt as well as the credit culture.

The U.S. economy faces recession risks.

While President Biden and members of his cabinet have downplayed recession risks, several indicators like the yield curve inversion and falling GDP point to an impending recession. Both these have been reliable indicators of a U.S. recession over the last seven decades.

The fall in inflation is a welcome break not only for consumers but also for the Federal Reserve. If inflation continues to come down, the Fed might decide to go slow on the rate hikes, which would be a big relief for the U.S. economy.