Equifax Error Caused Inaccurate Credit Scores for Millions of Customers

Equifax sent inaccurate credit scores to millions of its customers earlier this year. What causes the inaccuracies? We'll explain the Equifax error.

Aug. 4 2022, Published 1:34 p.m. ET

A lot of lenders depend on accurate credit scores to determine whether or not to extend loans to a person. It's important for people applying for loans and other credits to get accurate information that depicts their actual credit worthiness. However, one of the three major credit bureaus, Equifax, might have made an error in this regard for millions of consumers. What happened and caused the Equifax error?

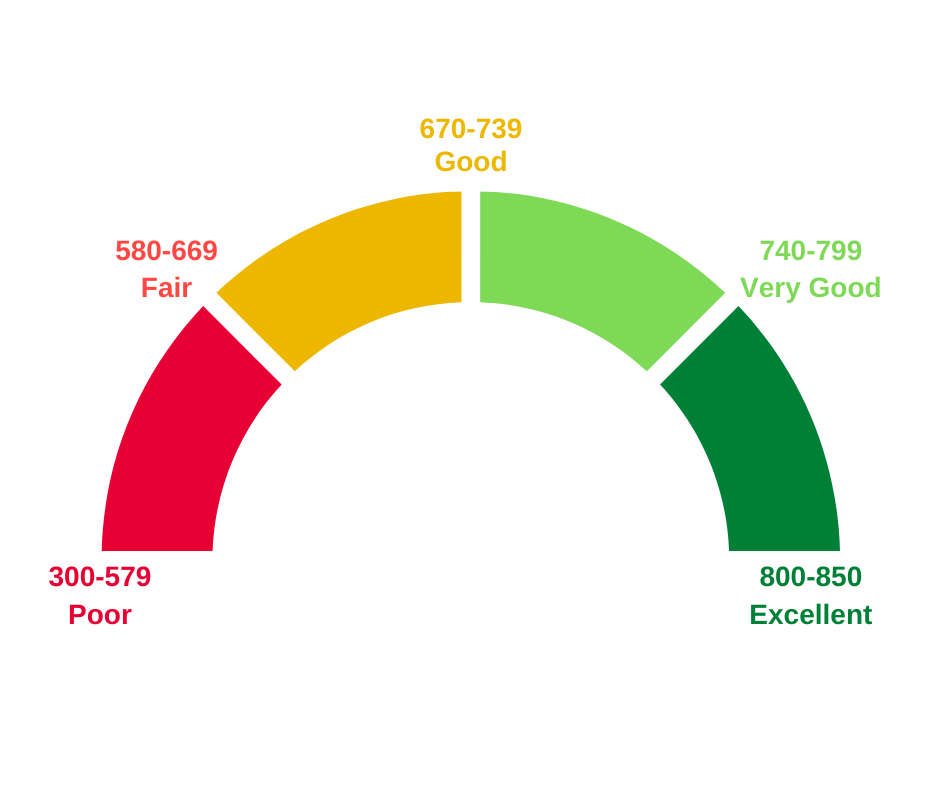

Equifax maintains credit reports of more than 200 million U.S. consumers and sells them to lenders. Lenders use credit scores to decide whether to provide loans to borrowers. Credit scores are three-digit numbers that are used to determine whether your credit cards and loan requests will be approved or denied.

Equifax provided inaccurate credit scores.

The Wall Street Journal reported that Equifax provided inaccurate credit scores for millions of U.S. consumers during a three-week period in March and April this year. The company only started disclosing the error in May. This news was previously carried by National Mortgage Professional in May, while Equifax CEO Mark Begor publicly acknowledged the error in June at a financial conference.

According to bank executives familiar with the matter, Equifax sent faulty credit scores for people who applied for loans such as auto loans, mortgages, and credit banks to banks and non-bank lenders. These institutions include JPMorgan Chase & Co., Wells Fargo, and Ally Financial.

The scores sent out by Equifax were sometimes off by 20 points in either direction. The lenders not only make the decisions regarding whether or not to extend loans but also the interest rates to be charged depending on borrowers’ credit scores. Therefore, erroneous credit scores might have swayed their decisions regarding offering loans and well as the interest rates charged to borrowers.

What caused the error with Equifax's credit scores?

The company mentioned that there was a technology coding issue within a program slated for replacement, which may have resulted in a potential miscalculation of certain attributes used to calculate credit scores.

The company maintained that the glitch didn't alter the information in consumers’ credit reports. Equifax also said that it has fixed the problem and that it takes issues with its data quality seriously. The company has been working closely with lenders and are providing them with updated scores.

Equifax in hot water.

Usually, lenders take into account credit scores from all of the three major credit bureaus — Equifax, Experian, and TransUnion. Therefore, an error of a few points from one credit agency might not have a significant impact on their decisions. However, an error of such a great magnitude from Equifax will certainly lead to a reputational dent for the company. The error could land the company in trouble with its regulator, the Consumer Financial Protection Bureau.

Equifax experienced a data breach back in 2017. It was one of the largest-ever data breach resolutions in the U.S., which exposed the personal information of approximately 147 million customers to hackers.