The Kraft Heinz Merger and Its Benefits

Pittsburgh-based H.J. Heinz Holding Corporation acquired Kraft Foods in October. After the merger, the company changed its name to Kraft Heinz.

Nov. 12 2015, Updated 12:05 a.m. ET

Details of the merger

The Pittsburgh-based, privately owned H.J. Heinz Holding Corporation acquired Kraft Foods in October. After the merger, the company changed its name to Kraft Heinz (KHC), becoming the third-largest food and beverage company in North America and the fifth-largest in the world. 3G Capital, a Brazilian private equity firm, and Warren Buffett’s Berkshire Hathaway contributed to the merger by investing $10 billion in the deal together, making the Kraft Heinz Company worth ~$46 billion.

Post-merger cost cutting

The company, with its plan to save $1.5 billion in annual costs by 2017, started with cutting about 2,500 jobs since the merger of the two US food giants faced sales challenges amid changing consumer tastes.

Bernardo Hees, CEO of the newly formed Kraft Heinz, said, “The job cuts are not surprising, given the reputation of the company’s management on Wall Street.” Hees also stated that he has overseen cost cutting at Heinz, representing 20% of the workforce, since it was taken over in 2013 in a prior partnership between 3G and Berkshire. The 3G Capital Company is well known for its tight cost controls, meaning the cuts announced on August 12 mostly affected people on the Kraft side of the business.

According to company spokesman Michael Mullen, the job cuts were part of the company’s process of integrating the two businesses and designing the new organization. The company expects that this new structure to eliminate duplication to enable faster decision-making, increased accountability, and accelerated growth.

Dividend declared

As per the company’s press release, on July 31, 2015, it paid a cash dividend of $0.55 per share to all stockholders of record at the close of business on July 27, 2015. This dividend was in lieu of the dividend declared on June 22, 2015, by Kraft to its shareholders of record as of July 27, 2015. The payment was conditional on the merger not having closed by that date.

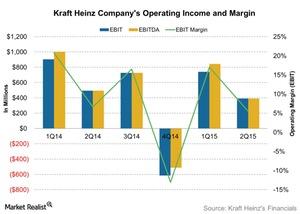

Kraft Heinz’s competitors in the industry include Mead Johnson (MJN), McCormick & Company (MKC), and Keurig Green Mountain (GMCR). They reported operating margins of 23.1%, 13.1%, and 16.6% in their last reported quarters. The First Trust NASDAQ-100 Ex-Technology Sector ETF (QQXT) invests 1.4% of its portfolio in the GMCR stock.