Kellogg Stock: Analysts’ Recommendations

Analysts continue to suggest a “hold” rating on Kellogg (K) stock. Analysts’ target price shows a downward trend.

Feb. 4 2019, Updated 1:20 p.m. ET

Analysts remain on the sidelines

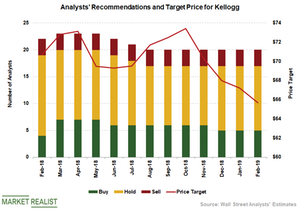

Analysts continue to suggest a “hold” rating on Kellogg (K) stock. Analysts’ target price shows a downward trend, which you can see in the following graph. Kellogg’s top line is expected to maintain its momentum in the fourth quarter. However, analysts expect the sales growth rate to slow down in the coming quarters as the company faces tough YoY comparisons and annualizes its acquisitions. Organic sales will likely remain weak, which reflects an unfavorable mix.

Kellogg’s profit margins and earnings are expected to remain pressured, which reflects a negative mix, cost headwinds, interest costs, and unfavorable currency rates.

Among the 20 analysts covering Kellogg stock, 12 recommended a “hold,” five recommended a “buy,” and three recommended a “sell.” Analysts have a consensus target price $65.67 per share, which implies an upside of 11.9% based on its closing price of $58.70 on February 1.

Stock performance

So far, Kellogg stock has risen 3% in 2019 and has underperformed the broader markets (SPX). The S&P 500 has risen 8.0% on a YTD basis as of February 1. In comparison, Mondelēz (MDLZ), General Mills (GIS), J.M. Smucker (SJM), and Kraft Heinz (KHC) stock have grown more than 10% in 2019.

Hershey (HSY) and McCormick (MKC) shares are trading in the red.