Why Tiffany Stock Plunged

Tiffany (TIF) disappointed investors with its comparable-store sales numbers in 1Q17. After results were announced, the company’s stock plunged ~9%.

Nov. 20 2020, Updated 2:50 p.m. ET

Tiffany stock fell 9%

Tiffany (TIF) disappointed investors with its comparable-store sales numbers in fiscal 1Q17, which ended April 30, 2017. After results were announced, the company’s stock plunged ~9%. Tiffany’s comps fell across all regions, which didn’t sit well with investors. Peer Signet Jewelers (SIG) was also affected by Tiffany’s dismal sales performance, and the company’s stock witnessed a fall of ~7%.

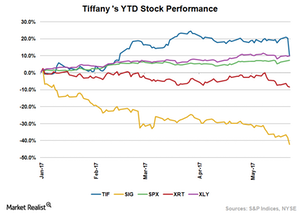

YTD stock performance

Until yesterday, Tiffany stock had seen astounding growth and outperformed the broader index by miles in terms of price gains. However, given the sharp decline in the company’s share price on May 24, it’s now up by only 10% on a YTD (year-to-date) basis. On the contrary, rival Signet’s stock slumped 42% since the beginning of the year. Meanwhile, the S&P 500 (SPX), the Consumer Discretionary Select Sector SPDR Fund (XLY), and the SPDR S&P Retail ETF (XRT) have returned 7.4%, 10.2%, and -8.3%, respectively.

Can Tiffany stock fall further?

In our previous series on Tiffany, we looked at whether the company’s fundamentals support its strong stock run in the current year or not. Despite the company’s strong trend reversal in 4Q16 and strategic initiatives to drive growth, the overall slump in consumer spending on big ticket items continues to weigh on its financials. Besides, Tiffany’s sales have been erratic. The company is striving to lift its sales in the Americas and Europe regions. Its Japan region, which until now contributed meaningfully to its growth, has also seen a decline during the reported quarter.

Despite a soft start to the current fiscal year, the company’s management remained confident and reiterated its guidance for fiscal 2017. The company’s productivity savings initiatives, new product offerings, store remodeling, and square footage expansion are expected to boost sales. However, weak consumer spending and a strong US dollar could restrict the company’s growth story in the near term.

Series overview

In this series, we’ll discuss Tiffany’s fiscal 1Q17 results. We’ll focus on the company’s performance on the profitability and sales fronts. We’ll also take a look at the company’s valuation and analysts’ recommendations.