What AstraZeneca Expects for EPS in Fiscal 2019

In its first-quarter press release, AstraZeneca (AZN) reiterated its guidance for core EPS of $3.50–$3.70 in fiscal 2019.

April 30 2019, Published 1:55 p.m. ET

EPS guidance

In its first-quarter press release, AstraZeneca (AZN) reiterated its guidance for core EPS of $3.50–$3.70 in fiscal 2019. The company expects its YoY (year-over-year) core operating profit growth to surpass its product sales growth in fiscal 2019, mainly due to productivity gains and operating leverage. However, it has guided for weaker cash performance in fiscal 2019 due to one-time payments related to prior business development transactions.

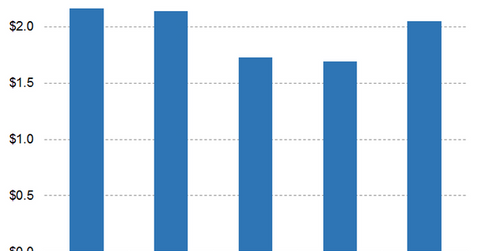

Analysts expect AstraZeneca’s non-GAAP EPS to fall 2.43% YoY to $1.69 in fiscal 2019 and rise by 21.33% to $2.05 in fiscal 2020 and 26.63% to $2.59 in fiscal 2021. They expect AstraZeneca’s non-GAAP EPS to fall 11.43% YoY to $0.31 in the second quarter of fiscal 2019, rise 10.48% YoY to $0.39 in the third quarter, and fall 37.13% YoY to $0.50 in the fourth quarter.

Profitability trends in the first quarter

In the first quarter, AstraZeneca’s gross margin expanded YoY by two percentage points to 79% YoY on a reported basis and three percentage points on a CER (constant exchange rate) basis. The company’s core gross margin expanded by two percentage points YoY to 80%. Its operating expenses rose 1% YoY to $3.89 billion on a reported basis and 5% on a CER basis, and its core operating expenses rose 1% YoY to $3.37 billion on a reported basis and 5% on a CER basis.

In the first quarter, AstraZeneca’s operating profit rose 58% YoY to $1.10 billion on a reported basis and 68% on a CER basis. Its core operating profit rose 84% YoY to $1.65 billion on a reported basis and 96% on a CER basis.