J.P. Morgan Raises Foot Locker’s Price Target, Adds to Focus List

Foot Locker (FL) has a market cap of $9.0 billion. It rose 0.76% to close at $67.58 per share on September 26.

Sept. 27 2016, Updated 4:04 p.m. ET

Price movement

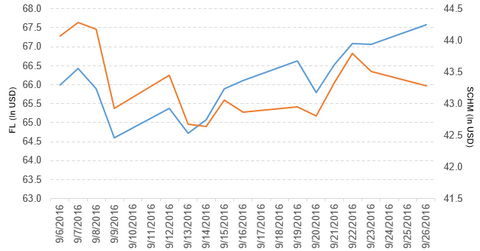

Foot Locker (FL) has a market cap of $9.0 billion. It rose 0.76% to close at $67.58 per share on September 26. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.4%, 1.0%, and 5.2%, respectively. FL is trading 2.5% above its 20-day moving average, 7.5% above its 50-day moving average, and 9.9% above its 200-day moving average.

Related ETFs and peers

The Schwab US Mid-Cap ETF (SCHM) invests 0.33% of its holdings in Foot Locker. The ETF tracks a market-cap-weighted index of midcap stocks in the Dow Jones US Total Stock Market Index. The YTD price movement of SCHM was 9.1% on September 26.

The iShares Morningstar Mid Core ETF (JKG) invests 0.49% of its holdings in Foot Locker The ETF tracks a market-cap-weighted index of US midcap firms that exhibit both growth and value characteristics as determined by multifactor selection.

The market caps of Foot Locker’s competitors are as follows:

Foot Locker’s rating

J.P. Morgan has increased Foot Locker’s price target to $79 from $76 per share and maintained the stock’s rating as “overweight.” J.P. Morgan has also put Foot Locker on its “focus list.”

Performance in fiscal 2Q16

Foot Locker reported fiscal 2Q16 sales of $1.8 billion—a rise of 5.9% compared to sales of $1.7 billion in fiscal 2Q15. The company’s cost of sales as a percentage of sales rose 3.0% in fiscal 2Q16 from the same period last year.

Its net income and EPS (earnings per share) rose to $127.0 million and $0.94, respectively, in fiscal 2Q16—compared to $119.0 million and $0.84, respectively, in fiscal 2Q15.

Foot Locker’s cash and cash equivalents fell 2.6% and its merchandise inventories rose 1.7% in fiscal 2Q16 compared to the same period last year. Its current ratio and debt-to-equity ratio rose to 3.8x and 0.46x, respectively, in fiscal 2Q16 from 3.4x and 0.44x, respectively, in fiscal 2Q15.

The company noted, “During the second quarter, the company opened 23 new stores, remodeled or relocated 64 stores, and closed 18 stores.”

Quarterly dividend

Foot Locker declared a quarterly cash dividend of $0.28 per share on its common stock. The dividend will be paid on October 28, 2016, to shareholders of record on October 14, 2016.

In the next part, we’ll discuss Sonoco Products (SON).