BHC’s Salix Segment: Xifaxan Drove Its Revenues in Q1

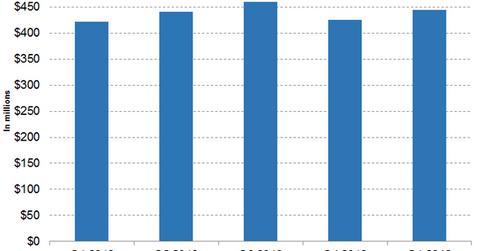

In the first quarter, Bausch Health Companies (BHC) reported revenues of $445 million for its Salix segment.

May 8 2019, Published 12:43 p.m. ET

Salix segment performance

In the first quarter, Bausch Health Companies (BHC) reported revenues of $445 million for its Salix segment—a rise of 5% YoY (year-over-year) on a reported constant currency and organic basis.

In the first-quarter earnings investor presentation, Bausch Health Companies estimated the negative impact of LOE (loss of exclusivity) of products on Salix’s revenues to be $55 million in the first quarter—a decline of $34 million YoY. The company has also estimated the negative impact of LOE on Salix’s profits to be $43 million in the first quarter—a decline of $23 million YoY.

Growth drivers

According to the first-quarter earnings conference call, the performance was mainly driven by Xifaxan. Xifaxan reported revenues of $306 million—a rise of 11% YoY (year-over-year). The drug also reported a rise of 8% YoY in total prescriptions in the first quarter. However, Uceris’s loss of exclusivity had a negative impact of $26 million on the segment’s revenues.

In the first quarter, Xifaxan reported a rise of 18% YoY in IBS-D (irritable bowel syndrome with diarrhea) prescriptions. According to IQVIA NPA weekly, Xifaxan accounts for 7% of the IBS-D market by prescription volume. Antispasmodics and antidiarrheals account for more than 90% of the market. There are significant growth opportunity available for Xifaxan in the IBS-D segment.

In the first quarter, Relistor reported revenues of $26 million—a rise of 30% YoY. Glumetza reported revenues of $38 million—a rise of 52% YoY. Relistor acquired a market share of more than 35% in the opioid-induced constipation category based on monthly prescriptions in the retail market.

Trulance’s strategy

According to the first-quarter earnings conference call, in the first 30 days after completing the acquisition of Synergy Pharmaceuticals in March, Bausch Health Companies has expanded its coverage for Trulance by 2.4 million lives across five regional plans. The company has also increased its frequency of calls to high volume prescribers by more than 30% to increase the recall value of the drug. Trulance accounts for a 4% share of the IBS-C/CIC (irritable bowel syndrome with constipation and chronic idiopathic constipation) branded market by total prescription volume. Amitiza and Linzess account for 29% and 67% of the market share, respectively.