Where Does Apple-Qualcomm Truce Leave Broadcom?

Broadcom (AVGO) is a leading supplier of smartphone components.

April 22 2019, Published 3:12 p.m. ET

Apple risked falling behind in 5G race

Broadcom (AVGO) is a leading supplier of smartphone components. Its range of products to the smartphone market include radio frequency chips, wireless charging chips, and Wi-Fi/Bluetooth connectivity chips. Apple is one of Broadcom’s top customers. In its latest annual filing, Broadcom disclosed that sales to Apple contributed 25% of its total revenue in its fiscal 2018, which was up from 20% in fiscal 2017.

Apple and Qualcomm (QCOM) this month reached a settlement that put an end to their nearly two-year legal dispute. For Qualcomm, the dispute cost it a revenue loss as Apple replaced it with Intel (INTC) as a supplier of modem chips for iPhones. For Apple, the dispute threatened to slow down its product roadmap, as Intel was not going to have its 5G smartphone modem chips ready before 2020. That meant that Apple could only begin shipping 5G iPhones in 2021 at the earliest, thereby falling behind some of its major rivals. For example, Samsung’s (SSNLF) first 5G smartphone, the Galaxy S10 5G, which uses Qualcomm chips, is expected to be released in the United States next month.

Broadcom’s orders from Apple could rise

If the Apple-Qualcomm settlement helps Apple to speed up the release of 5G the iPhone (since it can now use Qualcomm’s 5G modem chips), Broadcom could benefit from increased demand for its smartphone components from Apple without waiting for too long.

Apple releasing a 5G-capable iPhone to the market quickly could also help the company avoid falling too far behind the competition, ensuring that one of Broadcom’s most important customers keeps its competitive advantages.

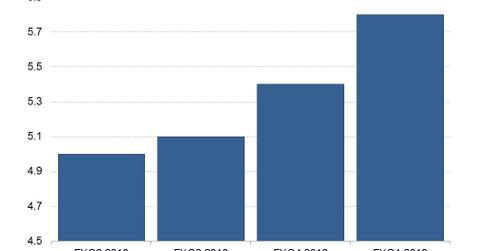

Broadcom generated revenue of $5.8 billion in its first quarter, which ended in December, representing an increase of 9.0% YoY. Revenue dropped around 1.6% YoY at Qorvo (QRVO) in the quarter ended in December.