TSMC Banks on Mobile and High-Performance Computing for Growth

TSMC (TSM) is the world’s largest foundry and manufactures chips for all major end markets.

Nov. 20 2020, Updated 10:46 a.m. ET

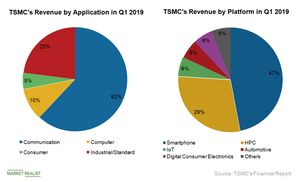

TSMC’s revenue by application

TSMC (TSM) is the world’s largest foundry and manufactures chips for all major end markets. The foundry divides its revenue into the four end-markets of Communication, Computer, Consumer, and Industrial/Standard. The shift in the technology landscape is creating new markets for semiconductors.

TSMC is changing its reporting style as per the new technology landscape. It will now divide revenue into six platforms: Smartphone, HPC (high-performance computing), IoT (Internet-of-Things), Automotive, Digital Consumer Electronics, and Others. The Communication and Industrial/Standard segments include smartphone chips and HPC chips used in communications infrastructure. The Consumer segment largely includes HPC chips and consumer electronics chips.

Smartphone

Smartphone consists of chips from Apple (AAPL), Qualcomm (QCOM), and Huawei as well as some standard chips. TSMC’s first-quarter revenue from smartphone fell 33% sequentially to $3.3 billion, accounting for 47% of its revenue. This segment will likely witness strong growth in the second half as seasonal sales pick up. It will also benefit from the settlement of a licensing dispute between Apple and Qualcomm. The settlement means that Qualcomm will supply some modem chips to Apple, and these chips will be manufactured at TSMC’s fabs.

High-performance computing

HPC comprises of CPUs (central processing units) and GPUs (graphics processing units) used in PCs and servers, 5G (fifth generation) networking chips, and other AI (artificial intelligence) accelerators like FPGAs (field programmable gate arrays). Its customers include Advanced Micro Devices (AMD), NVIDIA (NVDA), and Xilinx. TSMC’s first-quarter revenue from HPC fell 26% sequentially to $2.0 billion, accounting for 29% of its revenue.

TSMC expects HPC revenue to grow in the double digit in the next five years as its three major customers, AMD, NVIDIA, and Xilinx, grow in the double digits.

IoT, Automotive, Digital Consumer Electronics, and Others

TSMC earns 24% of its revenue from four platforms: IoT, Automotive, Digital Consumer Electronics, and Others. Each platform accounts for 5% to 7% of the revenue.

TSMC’s new reporting structure is expected to give more clarity around the financial health of its customers.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!