ANTM or CI: Comparing Their Revenue Growth in 2019

In its fourth-quarter earnings press release, Anthem (ANTM) guided for 2019 operating revenue of $100 billion, a YoY (year-over-year) rise of $8.7 billion.

April 15 2019, Published 2:31 p.m. ET

Revenue guidance

In its fourth-quarter earnings press release, Anthem (ANTM) guided for 2019 operating revenue of $100 billion, a YoY (year-over-year) rise of $8.7 billion, or 9.5%. The company also guided for premium revenue of $90.5 billion–$92.5 billion for 2019, a YoY rise of $5.1 billion–$7.1 billion, or 6.0%–8.3%.

In the fourth quarter, Anthem reported operating revenue of $23.30 billion, a YoY rise of 3.82% and $41.12 million higher than the consensus estimate driven mainly by robust growth in its government-sponsored business. However, according to Anthem’s fourth-quarter earnings conference call, its individual marketplace business had reported a YoY decline of 933,000 members as of the end of the fourth quarter due to the company’s planned exits from certain markets.

According to the company’s fourth-quarter earnings conference call, it plans to increase investments in areas such as healthcare provider collaboration, AI, and clinical and digital integration.

In its fourth-quarter earnings press release, Cigna (CI) guided for adjusted revenue in the range of $131.50 billion–$133.50 billion. The company reported revenue of $13.75 billion in the fourth quarter, a YoY rise of 30.86% and $2.37 billion above the consensus estimate.

On December 20, 2018, Cigna issued a press release announcing the completion of its acquisition of Express Scripts. According to Cigna’s fourth-quarter earnings conference call, following the acquisition, the combined company will have five reporting segments: Group Disability and Other, Corporate, International Markets, Health Services, and Integrated Medical.

Wall Street’s projections

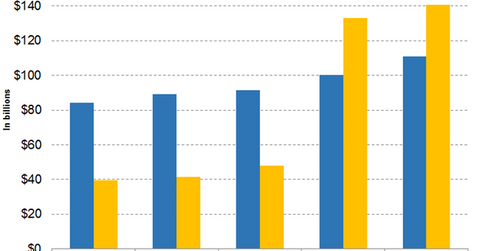

Wall Street analysts expect Anthem’s revenues to be $100.48 billion, $111.06 billion, and $121.09 billion, respectively, in 2019, 2020, and 2021, implying YoY rises of 10.00%, 10.53%, and 9.03%, respectively.

On the other hand, Wall Street analysts expect Cigna’s revenues to be $132.94 billion, $140.66 billion, and $149.01 billion, respectively, in 2019, 2020, and 2021, implying YoY rises of 176.32%, 5.81%, and 5.94%, respectively.