Fitness Trackers Are Likely to Hit Fitbit’s Sales in 2019

Though Fitbit’s smartwatch sales rose 437% in 2018, the company posted negative overall revenue growth.

April 9 2019, Published 1:35 p.m. ET

Smartwatch accounted for 44% of total sales last year

Fitbit (FIT) is one of the top players in the wearables space. It competes with tech giants such as Apple and Xiaomi as well as with niche players such as Garmin (GRMN) and Fossil (FOSL) in the space.

Fitbit stock saw an impressive rally between December 2018 and February 28, 2019, when it rose 38.5% driven by solid forecasts during the holiday season. Optimism about Fitbit’s Versa drove its revenue in the fourth quarter and beyond.

Though Fitbit’s smartwatch sales rose 437% and accounted for 44% of its total sales in 2018, the company posted negative overall revenue growth.

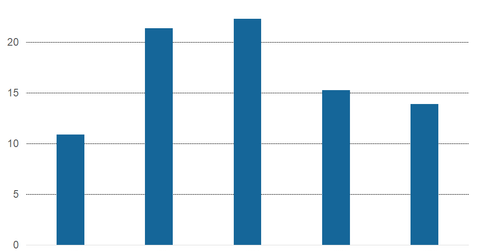

In fact, Fitbit’s sales fell more than 6% year-over-year in 2018. This sales decline was driven by tepid fitness tracker sales for Fitbit, which offset its robust smartwatch growth. Its total number of devices sold fell from 15.3 million in 2017 to 13.9 million in 2018.

Profit margins affected

Fitbit’s 2018 gross margin contracted to 39.9% from 42.8% in 2017. Its device mix, however, drove its average selling price up 4% to $105. Though Fitbit is the number-two selling smartwatch company in the United States, it sells its devices at an aggressive price point to expand its consumer base.

The gross margins of Fitbit’s smartwatches are much lower than those of other fitness trackers and are thereby affecting its profit margins.

If we consider the chart above, we can see that Fitbit’s device sales have now fallen for two consecutive years. Though Fitbit expects its total device sales to rise this year, their average selling price is expected to fall. Wall Street was unimpressed after Fitbit forecast sales growth of 1%–4% for 2019.