Chevron: Analysts’ Recommendations

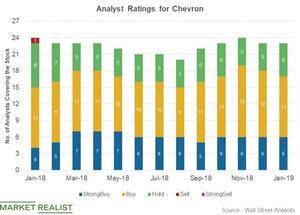

In January, 23 analysts rated Chevron (CVX). Among the analysts, 17 (or 74%) recommended a “buy” or “strong buy.”

Nov. 20 2020, Updated 2:11 p.m. ET

Analysts’ recommendations

In January, 23 analysts rated Chevron (CVX). Among the analysts, 17 (or 74%) recommended a “buy” or “strong buy,” while six (or 26%) recommended a “hold.” None of the analysts recommended a “sell” rating on the stock.

Recently, HSBC downgraded Chevron from “buy” to “hold.” The firm has also lowered its target price on Chevron stock from $136 per share to $122 per share. Barclays cut its target price on Chevron stock from $148 per share to $136 per share. J.P. Morgan reduced its target price on the stock from $140 per share to $138 per share. Chevron’s mean target price of $138 per share implies a 24% gain from the current level.

Most analysts rate Chevron as a “buy”

Chevron’s financials have been getting stronger. The company had healthy cash flows from operations in the third quarter. Chevron’s debt position got stronger during the quarter.

Chevron has a strong upstream portfolio, which is expected to drive its volumes growth. Chevron’s mega-projects like Gorgon and Wheatstone have started delivering results. Chevron expects its volumes to grow ~7% in 2018, which is at the higher end of its forecast range of 4%–7%. Wall Street analysts expect Chevron’s earnings to increase 117% in 2018—the highest among its peers.

Analysts’ ratings for peers

Equinor (EQNR), YPF (YPF), and Petrobras (PBR) have been rated as a “buy” by 33%, 79%, and 36% of the analysts, respectively. ExxonMobil (XOM), BP (BP), and Royal Dutch Shell (RDS.A) have been rated as a “buy” by 32%, 55%, and 82% of the analysts, respectively.

Next, we’ll discuss Chevron’s dividend yield before its earnings.