A Look at Fitbit’s Estimated Revenue and Earnings Growth in 2019

The entry of Apple, Xiaomi, Huawei, and Samsung into the wearables space has drastically reduced Fitbit’s market share.

April 9 2019, Published 1:35 p.m. ET

Fitbit’s sales are expected to rise 26.7% in 2019

Fitbit was once the market leader in the wearables market. However, the entry of tech giants such as Apple, China’s (FXI) Xiaomi and Huawei, and South Korea’s Samsung (SSNLF) into this space has drastically reduced Fitbit’s market share over the last few quarters, not only affecting its sales but also pressuring its profit margins.

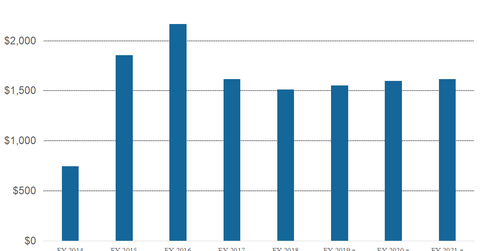

As we can see in the chart above, analysts expect Fitbit’s revenue to rise 2.9% YoY (year-over-year) to $1.56 billion in 2019 compared to $1.51 billion in 2018. Its sales are further expected to rise 2.9% to $1.6 billion in 2020 and 0.9% to $1.61 billion in 2021.

Comparatively, its non-GAAP (generally accepted accounting principles) EPS are expected to rise 15% in 2019 to -$0.17 from -$0.20 in 2018. The company’s EPS are then expected to rise 52% to -$0.08 in 2020.

Analysts expect Fitbit’s EPS to rise at a compound annual growth rate of 10.5% over the next five years. Despite the increase in its EPS, Fitbit is still struggling to be non-GAAP profitable.

Fitbit will post positive EBITDA in 2020

Driven by revenue and earnings growth, Fitbit’s EBITDA is expected to rise from -$7 million in 2019 to -$24.1 million in 2020 and then fall to $11.7 million in 2021.

Its operating profit might also improve from -$63.4 million in 2019 to -$39.7 million in 2020 and -$39.5 million in 2021. Fitbit was profitable way back in 2015 with an operating margin of 20% and a net margin of 6.6%. The company’s operating margin is expected to expand from -5.5% in 2018 to -4% in 2019, -2.5% in 2020, and -2.4% in 2021.

Similarly, the company’s net margin is expected to improve from -12.3% in 2018 to -9.3% in 2019, -7.8% in 2020, and -5.2% in 2021.