A Look at Activision Blizzard’s Valuation

Activision Blizzard (ATVI) has a forward PE ratio of 35.9x for 2019.

April 12 2019, Published 8:14 a.m. ET

PE ratio

Activision Blizzard (ATVI) has a forward PE ratio of 35.9x for 2019. This ratio might seem high given the company’s negative revenue and earnings growth this year. Its forward PE for 2020 is 25.4x. If we compare this ratio to its estimated revenue and earnings growth of 10.5% and 16.8%, respectively, we’ll see that the stock is still trading at a premium.

Activision Blizzard will have to grow its bottom line and continue to beat Wall Street analysts’ estimates to keep investors interested. Peer companies Electronic Arts (EA) and Take-Two Interactive (TTWO) are trading at forward 2019 PE ratios of 29.7x and 28.9x, respectively.

Price-to-book ratio

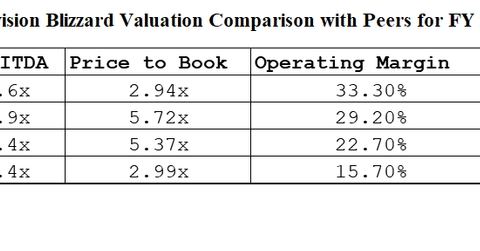

Activision Blizzard has the lowest price-to-book ratio among its peers at 2.94x. EA, TTWO, and Zynga (ZNGA) have price-to-book ratios of 5.72x, 5.39x, and 2.99x, respectively.

Profit margins

ATVI has the highest operating margin among its peers at 33.3%. EA’s, TTWO’s, and Zynga’s operating margins are comparatively low at 29.2%, 22.7%, and 15.7%, respectively. EA, however, leads with a net margin of 21% compared to 17% for ATVI and 12.6% for TTWO.

ROA and ROE

ATVI’s ROA (return on assets) is lower at 8.5%, while its return on equity stands at 12.6%. EA, TTWO, and Zynga have ROAs of 16.9%, 12.4%, and 6.9%, respectively.