Why Analysts Expect Shake Shack’s EPS to Fall in Q4

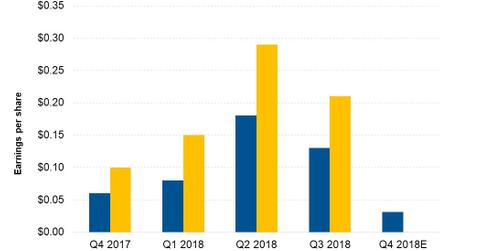

In the fourth quarter, analysts expect Shake Shack (SHAK) to post adjusted EPS of $0.03, a fall of 69% from $0.10 in the corresponding quarter of 2017.

Dec. 4 2020, Updated 10:52 a.m. ET

Analysts’ EPS expectations

In the fourth quarter, analysts expect Shake Shack (SHAK) to post adjusted EPS of $0.03, a fall of 69% from $0.10 in the corresponding quarter of 2017. The fall in its EBIT margin, partially offset by revenue growth and a lower effective tax rate, will likely lower its EPS in the fourth quarter.

Analysts expect Shake Shack’s EBIT margin to fall from 6.5% to 1.3% due to an increase in its cost of goods sold, higher labor expenses, and higher G&A (general and administrative) expenses. Higher beef prices are also expected to raise its cost of goods sold. The increase in hourly wages and the introduction of new lower-volume restaurants are expected to increase SHAK’s labor expenses during the quarter. The company’s G&A expenses are expected to rise due to its investment in the Project Concrete initiative, which is in place to upgrade the company’s operational and financial systems.

Analysts expect Shake Shack’s effective tax rate for the quarter to be 26.9% compared to 28.9% in the fourth quarter of 2017. Its lower effective tax rate is expected to offset some of the declines in its EPS.