What Drove Altria’s Revenue in the Fourth Quarter?

The segment has posted revenue of $4.1 billion, which represents a rise of 1.9% from $3.94 billion in the fourth quarter of 2017.

Feb. 1 2019, Updated 9:40 a.m. ET

Fourth-quarter revenue

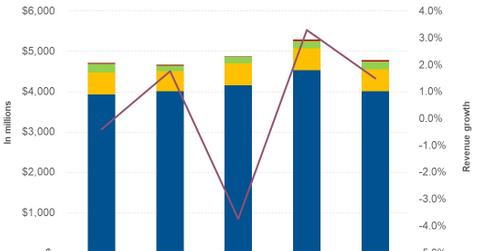

In the fourth quarter, Altria Group (MO) posted revenue, net of excise tax, of $4.79 billion, which fell short of analysts’ expectation of $4.81 billion. However, year-over-year, the company’s revenue increased by 1.5% driven by growth in the smokeable segment’s revenue, partially offset by a decline in revenue from the smokeless and wine segments. Let’s look at the company’s performance across segments.

Smokeable segment

The Smokable segment posted revenue of $4.1 billion, which represents a rise of 1.9% from $3.94 billion in the fourth quarter of 2017. The revenue growth was driven by favorable pricing and lower promotional investments, partially offset by a decline in shipment volume of 4.3%. During the quarter, the cigarette shipment volume declined by 4.4%, while the cigar shipment volumes increased by 2.9%.

Smokeless segment

The revenue from the Smokeless segment fell by 0.2% to $541 million. The decline in shipment volume of 1.9% lowered the segment’s revenue, which was partially offset by favorable pricing. During the quarter, the shipment volume of Copenhagen and Skoal fell 1.5% and 3.9%, respectively.

Wine segment

The revenue, net of excise tax, from the segment declined by 10.5% to $196 million. The decline in shipment volume lowered the segment, which was partially offset by a favorable mix.

Peer comparisons

During the same period, Philip Morris International (PM) is expected to post revenue, net of excise tax, of $7.38 billion, which represents a fall of 11.1% from $8.29 billion in the corresponding quarter of 2017.

Next, we will look at Altria’s fourth-quarter EPS.