What Analysts Expect from Coca-Cola’s Q4 Profitability

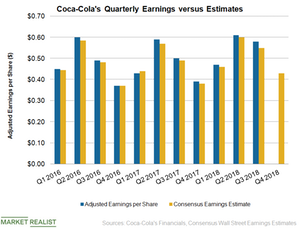

The Coca-Cola Company (KO) has exceeded analysts’ earnings estimates for six consecutive quarters.

Feb. 11 2019, Updated 11:20 a.m. ET

Improvement in bottom line

The Coca-Cola Company (KO) has exceeded analysts’ earnings estimates for six consecutive quarters. The company’s adjusted EPS rose 16.0% to $0.58 in the third quarter, beating analysts’ expectation of $0.55. Coca-Cola’s third-quarter bottom line grew due to improved margins, the timing of certain expenses, and lower taxes.

Coca-Cola’s third-quarter gross margin expanded 30 basis points year-over-year to 62.9%. The company’s third-quarter adjusted gross margin was 63.0%, reflecting a 20-basis-point improvement. Coca-Cola’s third-quarter gross margin benefited from its refranchising of its bottling operations partially offset by the impact of its adoption of a new revenue recognition standard.

Coca-Cola’s third-quarter operating margin expanded over 590 basis points to 30.6% on a reported basis. The company’s third-quarter adjusted operating margin expanded 575 basis points to 32.7%. This major improvement in Coca-Cola’s operating margin was driven by its productivity initiatives partially offset by the impact of adverse foreign currency movements and its new revenue recognition standard.

Earnings expectations

Analysts expect Coca-Cola’s adjusted EPS to rise 10.3% to $0.43 in the fourth quarter. Analysts expect the company’s 2018 adjusted EPS to rise 9.4% to $2.09. Coca-Cola’s guidance for its 2018 adjusted EPS growth is in the 8%–10% range.

Coca-Cola has been increasing the pricing of its products in key markets to offset the impact of higher input and transportation costs. The company’s 2018 margins are expected to be enhanced by the impact of its refranchising of its lower-margin bottling business and its continued productivity efforts.