Wall Street Analysts’ View on PVH Corp Is Positive

PVH Corp stock is covered by 16 analysts—63% of the analysts recommended a “buy,” 31% recommended a “hold,” and 6% recommended a “sell.”

May 23 2017, Updated 7:37 a.m. ET

Wall Street analysts’ view on PVH Corp

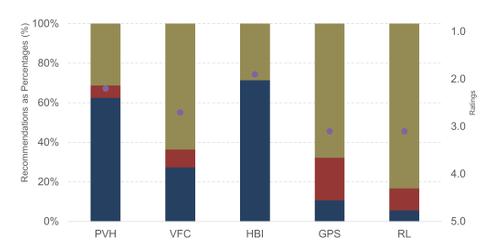

Wall Street analysts have a positive view on PVH Corp (PVH). The company’s stock received a rating of 2.3 on a scale of 1 (strong buy) to 5 (strong sell). PVH Corp’s rating is better than the ratings of VF Corp (VFC), Ralph Lauren (RL), and Gap (GPS), which are rated 2.7, 3.1, and 3.1, respectively.

Analysts’ recommendations

PVH Corp stock is covered by 16 analysts—63% of the analysts recommended a “buy” on the stock. In comparison, 27% and 6% of the analysts recommended a “buy” on VF Corp and Ralph Lauren. Hanesbrands (HBI), with 71% “buy” ratings, is the most preferred apparel stock by Wall Street analysts.

It’s important to note that 31% of the analysts recommended a “hold” on PVH Corp stock, while 6% recommended a “sell.”

Target price and gain potential

Currently, PVH Corp is trading at $100.41, which is ~15% below its 52-week high price. Analysts expect the company’s stock price to touch $112.27 in the next 12 months, which indicates upside potential of 12%.

The company has better upside than VF Corp and Ralph Lauren. The stock prices of these two companies are projected to gain 4% and 9%, respectively. Hanesbrands’ stock is expected to gain ~25% in the next 12 months.

Valuations

Currently, PVH Corp is trading at a one-year forward price-to-earnings ratio of 13.3x—lower than its three-year average of 14.4x. It trades at a discount to peers VF Corp at 17.3x and Ralph Lauren at 14.3x. It trades at a premium to Hanesbrands at 10.2x and Gap at 11.8x.

ETF investors seeking to add exposure to PVH Corp can consider the PowerShares S&P 500 High Beta Portfolio (SPHB), which invests ~1% of its portfolio in PVH Corp.