HollyFrontier Stock Has Recovered 5.5% in 2019

HollyFrontier (HFC) stock has risen 5.5% since January 2. The stock has risen less than its peers Marathon Petroleum (MPC) and Valero (VLO).

Dec. 4 2020, Updated 10:53 a.m. ET

HollyFrontier’s performance

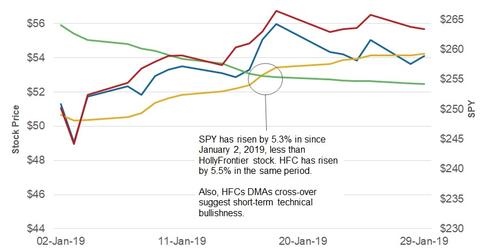

HollyFrontier (HFC) stock has risen 5.5% since January 2. The stock has risen less than its peers Marathon Petroleum (MPC) and Valero (VLO). Since January 2, Marathon Petroleum and Valero have risen 7.5% and 7.4%, respectively. The broader market indicator, the SPDR S&P 500 ETF (SPY), has risen 5.3% since January 2.

HollyFrontier’s moving averages

HollyFrontier’s 10-day moving average stood below its 30-day moving average on January 2. However, the rise in HollyFrontier stock in the month pushed up its 10-day moving average. The stock’s 10-day moving average has risen 7.1% since January 2.

HollyFrontier’s 10-day moving average has crossed over its 30-day moving average, which is a good sign. HollyFrontier’s 10-day moving average, which stood 9.4% below its 30-day moving average on January 2, now stands 3.4% above its 30-day moving average. Usually, when a short-term moving average crosses over a long-term moving average, it’s considered a technically bullish sign.

How is HollyFrontier stock placed after its recent recovery?

HollyFrontier is trading at a forward PE of 8.7x, below the peer average of 9.3x. HollyFrontier’s earnings are expected to rise 161% in 2018, higher than the average growth of 136% among its peers. HollyFrontier is expected to post its earnings results on February 20.

However, HollyFrontier’s current dividend yield stands at 2.5%, below the peer average of 3.4%. In the first nine months of 2018, HFC provided shareholder returns via dividends worth $176 million and stock repurchases worth $177 million.

Overall, HollyFrontier has a higher growth expectation for 2018 and low valuations. The company also has a relatively low dividend yield.

In the next article, we’ll evaluate PBF Energy’s returns.