ET, EPD, and KMI: Analysts’ Views and Target Prices

According to analysts’ estimates, Energy Transfer (ET) stock has a median target price of $21.24—compared to its current market price of $14.82.

July 17 2019, Updated 6:25 a.m. ET

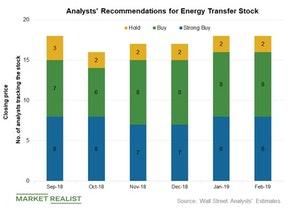

Analysts’ recommendations

According to analysts’ estimates, Energy Transfer (ET) stock has a median target price of $21.24—compared to its current market price of $14.82, which suggests an upside potential of 43.3% over the next 12 months.

Among the 18 analysts covering Energy Transfer stock, eight recommended a “strong buy,” eight recommended a “buy,” and two recommended a “hold.” None of the analysts recommended a “sell” as of February 14. Barclays gave Energy Transfer stock an “overweight” rating with a target price of $21 last week.

Enterprise Products Partners (EPD) has a target price of $33.5, which indicates a potential upside of ~19% from its current price of $28.06. Among the 23 analysts surveyed by Reuters covering Enterprise Products Partners, 12 recommended a “strong buy,” ten recommended a “buy,” and one recommended a “hold.”

Kinder Morgan (KMI) offers an estimated upside of ~14% based on its median target price of $21.28. Currently, Kinder Morgan is trading at $18.74. Among the 20 analysts covering Kinder Morgan, ten recommended a “strong buy,” eight recommended a “buy,” one recommended a “hold,” and one recommended a “strong sell.”