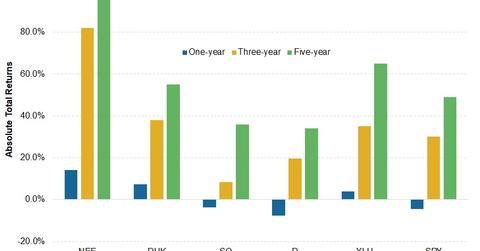

NEE, DUK, SO, and D: Comparing Top Utilities’ Total Returns

NextEra Energy (NEE) beat its peers in terms of returns in the last few years. NextEra Energy returned 14% in 2018.

Nov. 20 2020, Updated 4:30 p.m. ET

Total return

NextEra Energy (NEE) beat its peers in terms of returns and outperformed in the last few years. NextEra Energy returned 14%, while Dominion Energy (D) returned -8% in 2018. We have considered the stock appreciation and dividends paid in a particular period to calculate the total returns. During the same period, the Utilities Select Sector SPDR ETF (XLU) returned more than 4%, while the S&P 500 returned -5%.

NextEra Energy outperformed utilities at large and broader markets in all of the periods considered.

Southern Company underperformed

Despite being one of the top-yielding utility stocks, Southern Company (SO) underperformed its peers. In the last five years, Southern Company returned 36%, while utilities at large returned 65%. Southern Company’s yield has been higher than peers’ average in the last five years. Due to Southern Company’s volatile market performance following poor earnings growth and power plant issues, the company underperformed its peers during this period.

Duke Energy (DUK), the second-largest utility by market cap, returned more than 7% in 2018. Duke Energy returned 55% in the last five years.

Utilities are termed as a “boring” sector due to slow market movements. However, utilities outperformed broader markets in the last five years. Utilities’ total returns were ~65%, while the S&P 500 returned 48% in the last five years.