Teva or Mylan: Who Has the More Promising Revenue Trajectory?

In its third-quarter earnings investor presentation, Teva Pharmaceutical (TEVA) forecast total 2018 revenue in the range of $18.6 billion–$19.0 billion.

Jan. 9 2019, Updated 4:30 p.m. ET

Revenue guidance

In its third-quarter earnings investor presentation, Teva Pharmaceutical (TEVA) forecast total 2018 revenue in the range of $18.6 billion–$19.0 billion. This guidance was a slight change from the guidance of $18.5 billion–$19.0 billion it had provided in August 2018 and the guidance of $18.3 billion–$18.8 billion it had provided in February 2018.

According to the investor presentation, the company also expects its North American business, which includes its US Generics, US Speciality, Canada, and Anda businesses, to report revenue of $9.0 billion in 2018. According to the company’s third-quarter conference call, it expects its generic business revenue to stabilize in future quarters due to its strategy of continuing only with profitable business lines and exiting loss-making product categories.

In its third-quarter earnings investor presentation, Mylan (MYL) forecast total 2018 revenue in the range of $11.25 billion–$12.25 billion, almost flat YoY (year-over-year).

Wall Street estimates

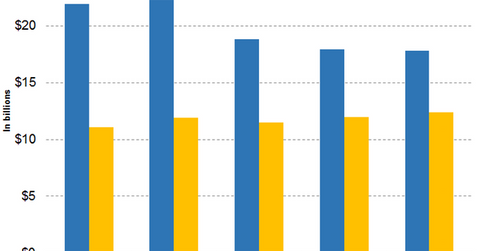

Wall Street analysts expect Teva Pharmaceutical’s revenues to be $18.85 billion, $17.94 billion, and $17.83 billion, respectively, in 2018, 2019, and 2020, implying YoY revenue falls of 15.81%, 4.82%, and 0.58%, respectively.

On the other hand, analysts expect Mylan’s revenues to be $11.49 billion, $11.99 billion, and $12.36 billion, respectively, in 2018, 2019, and 2020, implying YoY revenue rises of -3.55%, 4.18%, and 3.30%, respectively.

Teva Pharmaceutical is expected to report a falling revenue trajectory, while Mylan is expected to report a modest rise in revenue from 2018 to 2020.

In the next article, we’ll compare the earnings growth prospects of Teva Pharmaceutical and Mylan in greater detail.