Johnson & Johnson to Focus on Increasing Research and Development

In its fourth-quarter earnings investor presentation, Johnson & Johnson (JNJ) has projected its effective tax rate for fiscal 2019 to fall in the range of 17% to 18%.

Jan. 31 2019, Updated 9:00 a.m. ET

Tax rate projections

In its fourth-quarter earnings investor presentation, Johnson & Johnson (JNJ) projected its effective tax rate for fiscal 2019 to fall in the range of 17% to 18%. Wall Street analysts expect Johnson & Johnson to report an effective tax rate of 17.32%, 17.14%, and 17.12% in fiscal 2019, fiscal 2020, and fiscal 2021, respectively.

R&D and SG&A investments

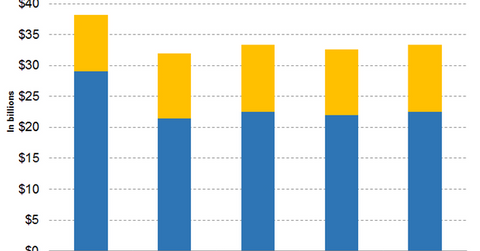

In fiscal 2018, Johnson & Johnson reported research and development (or R&D) expense of $10.8 billion, which was one of the highest research investments in the pharmaceutical industry. According to Johnson & Johnson’s fourth-quarter earnings conference call, the company invested $1.0 billion in lucrative acquisitions and collaborations including Arrowhead, argenx, Zarbee’s, and Orthotaxy in fiscal 2018.

The company expects a higher level of R&D investment in the first half of 2019. Wall Street analysts expect Johnson & Johnson to report R&D expenses of $10.63 billion in fiscal 2019, a YoY drop of 1.39%. The company is expected to report R&D expense of $10.87 billion in fiscal 2020, a YoY rise of 2.31%. Johnson & Johnson is also expected to report R&D expenses of $11.26 billion in fiscal 2021, a YoY rise of 3.58%.

Wall Street analysts expect Johnson & Johnson to report selling, general, and administrative (or SG&A) expense of $22.00 billion in fiscal 2019, a YoY drop of -2.39%. The company is expected to report SG&A expense of $22.47 billion in fiscal 2020, a YoY rise of 2.15%. Johnson & Johnson is also expected to report SG&A expense of $22.82 billion in fiscal 2021, a YoY rise of 1.54%.

In the next article, we’ll discuss key headwinds and tailwinds for Johnson & Johnson for fiscal 2019.