Does Tencent Music Entertainment Have Bright Future?

Tencent Music Entertainment (TME) held its IPO in December, pricing shares at $13 and raising $1.1 billion.

Jan. 10 2019, Updated 11:15 a.m. ET

Stock has decent upside potential

Tencent Music Entertainment (TME) held its IPO in December, pricing shares at $13 and raising $1.1 billion. The debut struck a chord with investors, as the stock jumped 8.0% on its first day of trading. What does the future hold for Tencent Music?

As Investor’s Business Daily reported, Wall Street firm KeyBanc Capital Markets recently initiated coverage of Tencent Music stock with an “overweight” rating and a $19 price target, suggesting upside potential of more than 46% over the stock’s $13 closing on January 8.

Monetizing the audience

According to KeyBanc, Tencent Music has a massive opportunity ahead, particularly in its domestic market of China. Tencent Music, with its more than 800 million active users, bills itself as China’s top online music platform. Tencent Music monetizes this audience in various ways including selling music subscriptions and advertising. Pandora (P) and Spotify (SPOT) also monetize their music audiences through subscription sales and advertising.

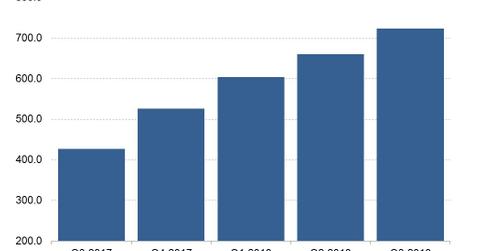

36% annual revenue growth

KeyBanc predicts Tencent Music could grow its revenue at the rate of 36% annually from 2018 through 2020. Tencent Music’s revenue rose 65% YoY to $722.2 million in the third quarter of 2018. Pandora and Spotify grew their revenues by 16% and 31% YoY, respectively, in the third quarter. Amazon (AMZN), another online music provider, grew its revenue by 29% YoY in the third quarter. Tencent Music separated from Tencent Holdings (TCEHY), the Chinese Internet giant that also owns a stake in Spotify.