Can Stanley Black & Decker’s Q4 Earnings Beat the Estimates?

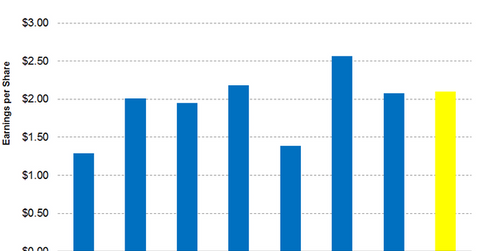

Stanley Black & Decker (SWK) is expected to post an adjusted EPS of $2.1 in the fourth quarter—a decrease of ~4.7% YoY (year-over-year).

Jan. 18 2019, Updated 11:15 a.m. ET

Stanley Black & Decker’s Q4 EPS estimates

Stanley Black & Decker (SWK) is expected to post an adjusted EPS of $2.1 in the fourth quarter—a decrease of ~4.7% YoY (year-over-year). In the first quarter of 2017, Stanley Black & Decker reported an adjusted EPS of $2.18.

The projected decrease in Stanley Black & Decker’s adjusted EPS could be driven by higher input costs due to an increase in raw material prices. As a result, Stanley Black & Decker’s cost of goods sold as a percentage of sales is projected to be 64.20%. The company’s cost of goods sold was 63.3% in the fourth quarter of 2017—an increase of 90 basis points on a year-over-year basis. In the third quarter, Stanley Black & Decker announced a cost reduction program of $250 million. The program could help reduce Stanley Black & Decker’s SG&A (selling, general, and administrative) expenses as a percentage of sales. Analysts expect Stanley Black & Decker’s fourth-quarter SG&A expenses to be 22.4% of the expected revenues. In the fourth quarter of 2017, Stanley Black & Decker reported SG&A expenses of $793.3 million, which represents 23.2% of the sales—a fall of 80 basis points on a YoY basis.

Share repurchase

At the end of the third quarter, Stanley Black & Decker’s outstanding shares were 150.6 million. In the past six months, Stanley Black & Decker spent $500 million on share repurchases in 2018. The trend is expected to continue. However, analysts don’t expect a change in the company’s outstanding shares from the previous quarter. We’ll have to see whether or not Stanley Black & Decker will reduce its outstanding shares.

Investors could hold Stanley Black & Decker indirectly by investing in the Invesco Zacks Mid-Cap ETF (CZA), which has invested 2.0% of its portfolio in Stanley Black & Decker. The fund’s other holdings include Tyson Foods (TSN), Paccar (PCAR), and Mylan (MYL) with weights of 2.1%, 2.0%, and 1.5%, respectively, as of January 17.