Invesco Zacks Mid-Cap ETF

Latest Invesco Zacks Mid-Cap ETF News and Updates

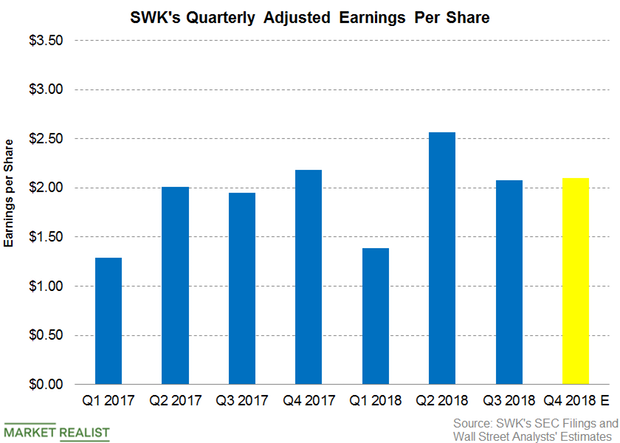

Can Stanley Black & Decker’s Q4 Earnings Beat the Estimates?

Stanley Black & Decker (SWK) is expected to post an adjusted EPS of $2.1 in the fourth quarter—a decrease of ~4.7% YoY (year-over-year).

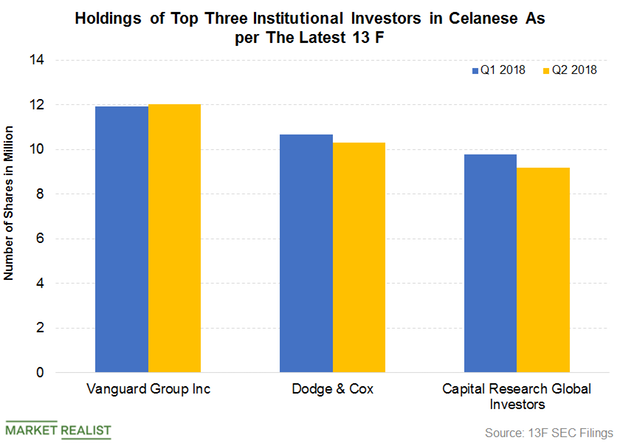

What Are Institutional Investors’ Positions on Celanese?

Second-quarter 13F SEC filings indicate that institutional investors own 95.3% of Celanese’s (CE) outstanding shares.

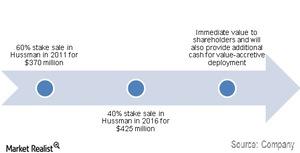

The Brass Tacks of the Ingersoll Rand-Hussmann Deal

Ingersoll Rand has agreed to sell its remaining equity interest of 40% in Hussmann to Panasonic. Panasonic will buy 100% shares according to the agreement.