Can China Recover Like It Did in 2016?

In some aspects, 2018 looked like 2015 for investors. Like in 2015, China’s (BABA) slowdown spooked investors in 2018.

Dec. 4 2020, Updated 10:53 a.m. ET

China

As we discussed in the previous part, Apple (AAPL) has lowered its revenue forecast due to the slowdown in China. Since China is the world’s largest metal consumer, metals tend to be hypersensitive to developments in China. Fears about China’s slowdown have triggered a sell-off in copper. The sell-off is seen as a bright spot in metal markets due to supportive demand-supply fundamentals.

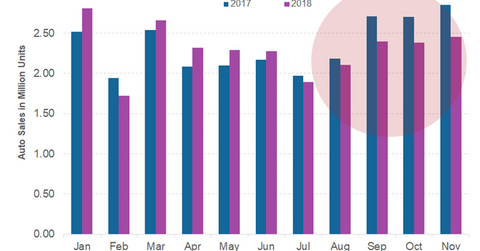

In 2015, concerns emerged about the Chinese economy (FXI), which triggered a sell-off in metals. Back then, China took a slew of measures to restore investors’ confidence. In the real estate sector, China relaxed lending norms to boost housing demand. In the automotive space (NIO), China lowered its purchase tax, which was gradually increased to the original level of 10% last year. China devalued its currency in 2015.

Similar to 2015?

In some aspects, 2018 looked like 2015 for investors. Like in 2015, China’s (BABA) slowdown spooked investors in 2018. In 2015, China’s stimulus for some sectors and monetary easing lifted the sagging economy. In 2018, China’s response was quite measured.

Last month, China talked about “significant” tax cuts. On the monetary policy side, China said that it would pursue a “prudent” policy. While China took some big steps in 2015 to stop the slowdown, it’s looking at more gradual measures this time. China has been looking at structural supply-side reforms where it’s trying to address the industrial overcapacity problem. China has been trying to address its debt problem and property speculation. So, the time-tested stimulus package wouldn’t match these objectives. Even currency devaluation might do more harm than good given the United States’ (QQQ) tough stance on trade.

Next, we’ll discuss China’s options given the current circumstances.