Bristol-Myers Squibbs and Celgene: Cost Synergies for Future Years

According to Bristol-Myers Squibb’s (BMY) press release, the company expects the acquisition of Celgene (CELG) to result in annual cost synergies close to $2.5 billion.

Jan. 8 2019, Updated 7:31 a.m. ET

Cost efficiencies

According to Bristol-Myers Squibb’s (BMY) press release, the company expects the acquisition of Celgene (CELG) to result in annual cost synergies close to $2.5 billion by 2022. According to the company’s investor presentation, Bristol-Myers Squibb expects around 55% of these cost synergies to be an outcome of optimized selling, general, and administrative (or SG&A) expenses realized through commercial efficiencies, geographic market optimization, and centralization of support functions.

Bristol-Myers Squibb also expects around 35% of these cost synergies to be an outcome of optimized research and development (or R&D) expenses realized through effective optimization of the combined company’s early-stage research pipeline and reduction in overlapping resources.

Bristol-Myers Squibb expects around 10% of the cost synergies to be an outcome of optimized manufacturing capabilities realized by leveraging the company’s biologics business footprint and by the introduction of operational efficiencies in procurement functions. According to the company’s investor presentation, despite the ambitious cost-cutting strategy, the combined company plans to protect its value drivers while retaining its key personnel. Bristol-Myers Squibb mainly plans to optimize expenses through effective leverage of scale.

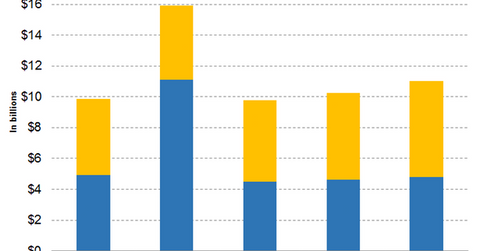

SG&A and R&D expense projections

Wall Street analysts have projected Bristol-Myers Squibb’s SG&A expenses to be $4.50 billion, $4.62 billion, and $4.79 billion for fiscal 2018, fiscal 2019, and fiscal 2020, respectively, which implies a YoY change of -59.45%, 2.74%, and 3.50% for fiscal 2018, fiscal 2019, and fiscal 2020, respectively.

Wall Street analysts have projected Bristol-Myers Squibb’s R&D expenses to be $5.27 billion, $5.59 billion, and $6.19 billion for fiscal 2018, fiscal 2019, and fiscal 2020, respectively. These estimates imply a YoY change of 9.33%, 5.99%, and 10.84% for fiscal 2018, fiscal 2019, and fiscal 2020, respectively. These estimates do not include the impact of the pending Celgene acquisition.

In the next article, we’ll discuss the key characteristics of the acquisition of Celgene by Bristol-Myers Squibb in greater detail.