LyondellBasell: Analysts’ Views and Recommendations

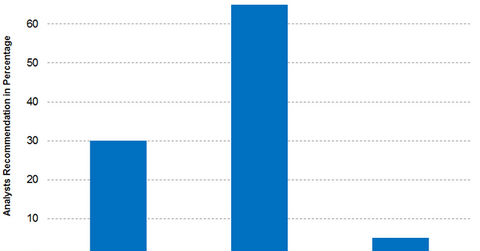

For LyondellBasell, 30% of the analysts recommended a “buy,” 65% recommended a “hold,” and 5% recommended a “sell.”

Dec. 7 2018, Updated 4:30 p.m. ET

Analysts’ consensus on LyondellBasell

In the past six months, the number of analysts tracking LyondellBasell (LYB) fell from 23 to 20. Among the analysts, 30% recommended a “buy,” 65% recommended a “hold,” and 5% recommended a “sell.”

Analysts’ consensus view indicates a target price of $106.5 for LyondellBasell, which implies a return potential of 20.7% over the closing price as of December 6. In the past three months, analysts have reduced their target price from $120.25 to the current target price.

In 2018, LyondellBasell’s earnings have beat analysts’ expectations in all three quarters. However, the increased input cost and the breakdown in the Houston refinery are major concerns. LyondellBasell has acquired A. Schulman. The company might acquire Braskem. LyondellBasell is also involved in joint ventures, which would help drive its future growth. As a result, most of the analysts recommended a “hold” on LyondellBasell.

Individual brokerages

- Jefferies (JEF) rated LyondellBasell as a “buy” and recommended a target price of $108, which implies a potential return of 22.4% over its closing price of $88.23 as of December 6.

- HSBC (HSBC) raised LyondellBasell to a “buy” rating and recommended a target price of $124, which implies a return potential of 40.5% over the closing price as of December 6.

- UBS (UBS) cut its target price on LyondellBasell to $94 from the previous target price of $111, which implies a return potential of 65% over the closing price as of December 6.

Investors could hold LyondellBasell indirectly by investing in the Invesco DWA Basic Materials Momentum ETF (PYZ). PYZ has invested 5.2% of its portfolio in LyondellBasell as of December 6.