Kellogg: Analysts Recommend a ‘Hold’

Most of the analysts covering Kellogg continue to maintain a neutral outlook on the stock, which reflects near-term pressure on its earnings.

April 25 2019, Published 12:29 p.m. ET

Analysts suggest a “hold”

Most of the analysts covering Kellogg (K) continue to maintain a neutral outlook on the stock, which reflects near-term pressure on its earnings. Analysts expect Kellogg’s profit margins to continue to decline, which will likely drag its earnings down.

Weak organic sales, a negative mix shift, and investments in brands are expected to drag the margins down. Weak margins, higher interest expenses, and the higher tax rate are expected to hurt Kellogg’s earnings. Analysts expect Kellogg’s earnings to decline in 2019.

However, the top line is expected to benefit from acquisitions and a gradual improvement in the company’s volumes and pricing.

Rating and target price

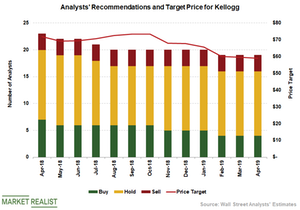

Among the 19 analysts covering Kellogg, 12 recommended a “hold,” four recommended a “buy,” and three recommended a “sell.” Analysts have a target price of $59 per share, which is almost on par with its closing price of $58.43 on April 23.

Analysts also recommended a “hold” on General Mills (GIS), J.M. Smucker (SJM), and Hershey (HSY) stock. The near-term pressure on the margins and EPS is keeping analysts on the sidelines.

In contrast, analysts recommended a “buy” on Conagra Brands (CAG) and Mondelēz (MDLZ) stock.