Why Most Analysts Recommend ‘Buy’ for Huntsman

Analysts’ consensus for Huntsman The number of analysts covering Huntsman (HUN) stock has increased from eight analysts to nine analysts in the last month. Among them, 89% of the analysts have recommended “buy,” and 11% have recommended “hold.” There were no “sell” recommendations. Analysts have raised Huntsman’s 12-month target price to $30.11 from $28.71, implying a potential […]

Sept. 18 2017, Updated 8:07 a.m. ET

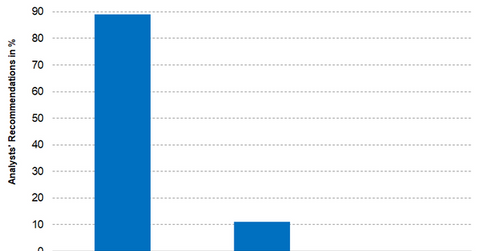

Analysts’ consensus for Huntsman

The number of analysts covering Huntsman (HUN) stock has increased from eight analysts to nine analysts in the last month. Among them, 89% of the analysts have recommended “buy,” and 11% have recommended “hold.” There were no “sell” recommendations.

Analysts have raised Huntsman’s 12-month target price to $30.11 from $28.71, implying a potential return of 9.6% based on its closing price on September 13, 2017. Huntsman’s agreement with Clariant to merge and form HuntsmanClariant is viewed as a big positive for Huntsman. The deal is valued at $20 billion, and is expected to bring synergies of $400 million in two years. The spin-off of its titanium dioxide pigment and performance additive business into Venator is also expected to add value for its shareholders. These positive developments may have prompted analysts to recommend “buy.”

Brokerage prices for Huntsman

- Jefferies has rated Huntsman a “buy” with a target price of $31, which implies a return potential of 12.8% based on its closing price of $27.48 on September 13, 2017.

- Keybanc has upgraded Huntsman to “overweight” from “sector weight,” but did not provide a target price.

Investors interested in Huntsman could consider the Vanguard Materials ETF (VAW), which has a 0.60% exposure to Huntsman. Other holdings of the fund include Monsanto (MON), Praxair (PX), and LyondellBasell (LYB), which had weights of 5.9%, 4.4%, and 3.7%, respectively, as of September 13, 2017. In the next part, we’ll look at Huntsman’s valuation.