What’s Driving BD’s Operating Margin Expansion

Overview BD (BDX) has registered strong operating margin expansion in recent years. Its margin improved by 100 basis points in fiscal 2015 and 200 basis points in fiscal 2016. In fiscal 2017, BD’s margin expanded by ~180 basis points. In 4Q17, BD’s operating margin grew ~14.6% YoY (year-over-year), limited by 700 basis points due to the divestiture of BD’s […]

Nov. 30 2017, Updated 9:02 a.m. ET

Overview

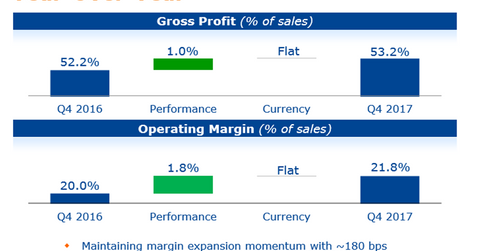

BD (BDX) has registered strong operating margin expansion in recent years. Its margin improved by 100 basis points in fiscal 2015 and 200 basis points in fiscal 2016. In fiscal 2017, BD’s margin expanded by ~180 basis points.

In 4Q17, BD’s operating margin grew ~14.6% YoY (year-over-year), limited by 700 basis points due to the divestiture of BD’s respiratory solutions business and US dispensing business changes. There was no currency impact on BD’s operating margins in 4Q17.

Major factors driving BD’s operating margin expansion

In 4Q17, process improvements and higher R&D (research and development) spending in prior-year quarters were the main drivers of BD’s margin improvement. A favorable product mix and cost synergies contributed to the growth. CareFusion cost synergies continue to be on track and BD is confident of achieving its synergy target of $350 million by fiscal 2018. In 2017, BD reported ~$250 million in CareFusion cost synergies.

Operating margin guidance for fiscal 2018

In fiscal 2018, BD expects an operating margin of 24%–25%. In fiscal 2017, its operating margin stood at 22.9% of its total sales. The company expects its operating margin to expand by 100–150 basis points in fiscal 2018. Therefore, its cumulative operating margin improvement over the last four years is expected to be around 600–654 basis points.

Peers Zimmer Biomet (ZBH), Medtronic (MDT), and Thermo Fisher Scientific (TMO) are expected to register operating margin growth of around 21%, 28%, and 25%, respectively. Investors seeking diversified exposure to BD could consider the iShares Edge MSCI Min Vol USA ETF (USMV), which has a ~1.7% exposure to BD.