Activision Blizzard’s Valuation Compared to Its Peers’

We’ve already seen that Activision Blizzard’s’ (ATVI) revenues are expected to rise 4.6% in 2018 and 6.3% in 2019.

Nov. 6 2018, Updated 9:00 a.m. ET

PE ratio

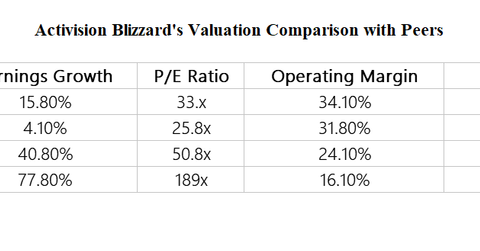

We’ve already seen that Activision Blizzard’s’ (ATVI) revenues are expected to rise 4.6% in 2018 and 6.3% in 2019. The company’s EPS are expected to rise 15.8% in 2018 and 11.7% in 2019. It has forward PE ratio estimates of 33.3x for 2018 and 31.1x for 2020. Activision stock may seem slightly overvalued considering its revenue and earnings growth rates.

Electronic Arts’ (EA), Take-Two Interactive’s (TTWO), and Zynga’s (ZNGA) PE ratios for their current years are 25.8x, 50.8x, and 189x, respectively. EA’s, Take-Two’s, and Zynga’s current revenue growths are estimated to be 1%, 43%, and 12%, respectively. While EA’s EPS are expected to rise 4.1% in its current year, Zynga’s and Take-Two’s are expected to rise 78% and 41%, respectively.

Take-Two Interactive’s and Zynga’s high PE ratios are supported by their high earnings growth rates.

ROA and ROE

ATVI’s ROAs (return on assets) are expected to be 11% in 2018 and 11.7% in 2019. EA’s, Take-Two’s, and Zynga’s ROAs are expected to be 18.7%, 12.2%, and 4.2%, respectively, in 2018.

ATVI’s ROEs (return on equity) are expected to be 18.1% in 2018 and 20.6% in 2019. EA’s, Take-Two’s, and Zynga’s ROEs are expected to be 29.5%, 27%, and 6.5%, respectively, in 2018.

Market cap-to-revenue ratio

ATVI is trading at a market cap-to-revenue ratio of 7.03x and an EV-to-EBITDA (enterprise value-to-EBITDA) ratio of 18.5x.

EA has a market cap-to-revenue ratio of 5.4x, while its EV-to-EBITDA ratio is 13x. Take-Two’s market cap-to-revenue ratio stands at 5.13x, while its EV-to-EBITDA ratio is 17.5x. Zynga has a market cap-to-revenue ratio of 3.4x, while its EV-to-EBITDA ratio is 15.2x.