Why Analysts Expect Chipotle’s EPS to Rise in Q1 2019

For 2019, analysts are projecting Chipotle to post adjusted EPS of $12.42, which represents a rise of 37.1% from $9.06 in 2018.

April 16 2019, Published 3:47 p.m. ET

Analysts’ expectation

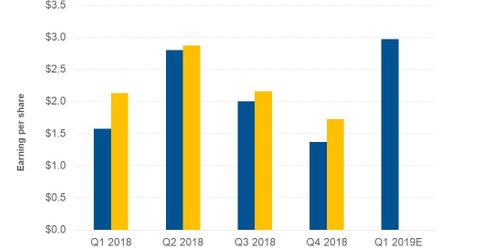

Analysts project Chipotle Mexican Grill (CMG) to post adjusted EPS of $2.97 in the first quarter of 2019, which represents a rise of 39.3% from $2.13 in the first quarter of 2018. The revenue growth, expansion of EBIT (earnings before interest and tax) margin, lower effective tax rate, and share repurchases are likely to drive the company’s EPS during the quarter.

Analysts are forecasting Chipotle’s EBIT margin to improve from 8.1% to 8.7%. The increase in menu prices, sales leverage from positive SSSG, better scheduling and managing labor, and improved efficiency from strategic review of the sourcing of its ingredients are expected to drive the company’s EBIT margins during the quarter. However, higher marketing and research expenditure and an increase in beef prices are expected to offset some of the increase in EBIT margins.

For the quarter, analysts are projecting the company’s effective tax rate to be at 28.1% compared to 36.9% in the first quarter of 2018. Since the beginning of the second quarter of 2018 until the end of the fourth quarter of 2018, the company has repurchased shares worth ~$93.0 million. In February, Chipotle’s board approved another $100 million for share repurchases in addition to ~$57.6 million available under its existing share repurchase program as of December 31.

Peer comparison

For the comparable quarter, analysts are expecting EPS for Shake Shack (SHAK) and McDonald’s (MCD) to fall by 13.9% and 1.5%, respectively.

Outlook

For 2019, analysts are projecting Chipotle to post adjusted EPS of $12.42, which represents a rise of 37.1% from $9.06 in 2018. The revenue growth, lower operating expenses, decline in effective tax rate, and share repurchases are expected to drive the company’s EPS.