What ViewRay’s Valuation Trend Indicates

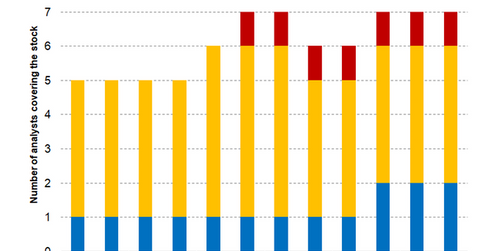

In September, of the seven analysts covering ViewRay (VRAY), six have given its stock “buy” or higher ratings, and one analyst has given it a “sell” rating.

Sept. 28 2018, Updated 1:53 p.m. ET

Analysts’ recommendations

In September, of the seven analysts covering ViewRay (VRAY), six have given its stock “buy” or higher ratings, and one analyst has given it a “sell” rating.

The mean rating for ViewRay stock is a 2, and its target price is $12.71, implying an upside potential of 30.8% over its closing price of $9.72 on September 27.

Peers’ ratings

In comparison, for peers Intuitive Surgical (ISRG), Medtronic (MDT), and Zimmer Biomet Holdings (ZBH), analysts have mean ratings of 2.06, 2.24, and 2.25, respectively, and target prices of $565.8, $102.45, and $136.39, respectively.

Valuation metrics

From $9.42 on January 4, ViewRay stock corrected to $6.21 on April 2. After that, it rose to a level of $12.44 on July 26, since which it’s fallen to its current level of $9.7 in September.

ViewRay’s market cap is $912.1 million, and its enterprise value-to-revenue ratio is 9.11. Its price-to-sales ratio is 12.20, and its price-to-book ratio is 19.25.

Its current ratio, a metric of how effectively a company can meet its short-term obligations, stands at 3.30. In comparison, the current ratios of its peers Intuitive Surgical (ISRG), Medtronic (MDT), and Zimmer Biomet Holdings (ZBH) stand at 6.0, 2.50, and 2.40, respectively.

ViewRay’s long-term debt-to-equity ratio stands at 1.17. In comparison, the long-term debt to equity ratios of its peers Medtronic and Zimmer Biomet Holdings stand at 0.47 and 0.78, respectively, indicating that ViewRay has taken on a higher level of leverage than its peers.