What Analysts Recommend for Stryker Stock

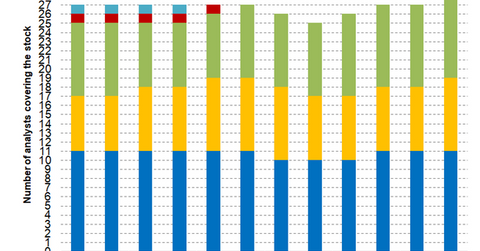

Of the total 28 analysts covering Stryker (SYK) in October 2018, 19 analysts have given the stock a “buy” or higher rating, and nine analysts have given Stryker a “hold” rating.

Oct. 19 2018, Updated 10:32 a.m. ET

Analyst recommendations

Of the total 28 analysts covering Stryker (SYK) in October 2018, 19 analysts have given the stock a “buy” or higher rating, and nine analysts have given Stryker a “hold” rating. The mean rating for Stryker is 1.93 with a target price of $187.27, which implies an upside potential of 8.2% over Stryker’s closing price of $173.1 on October 18.

In comparison, peers Baxter International (BAX), Boston Scientific (BSX), and Zimmer Biomet Holdings (ZBH) have a mean rating of 2.41x, 1.52x, and 2.31x, respectively, and a target price of $79.79, $41.57, and $136.92, respectively.

Price performance

After a strong run up from $148.01 on February 8 to a high of $179.78 on June 6, Stryker stock has been within a range of $162 and $179 over the last three months. In the past one week, Stryker stock has witnessed buying interest and is trading at the present $173 levels.

The enterprise value of Stryker is $71.19 billion, and its enterprise value-to-revenue ratio is 5.46x. The stock is trading at a forward price-to-earnings multiple of 21.77x. Its price-to-sales ratio and price-to-book ratios are 4.96x and 6.84x, respectively.

The current ratio of Stryker, a metric of how effectively a company can meet its short-term obligations, stands at 1.80x. In comparison, the current ratio of peers Baxter International (BAX), Boston Scientific (BSX), and Zimmer Biomet Holdings (ZBH) stand at 2.60x, 0.80x, and 2.40x, respectively.